Our tech is trusted by:

70%

The increase in top of funnel our clients see on average

45%

The average increase our clients see to 'approval' conversions

20%

The decrease our clients see in cost to serve

Xapii Convert Popular Features

Help customers make informed decisions

Attract more top-of-funnel volume through engaging experiences supported by data-driven actionable insights

Boost Conversions

Frictionless calculators for all funnel types

Used by some of Australia's largest banks and brands, drive higher conversions with a suite of hardened calculator APIs including repayment, saving scenarios, upfront costs and borrowing power.

Managed reference data sources including tax rates, household expenditure measure (HEM), lenders mortgage insurance (LMI) premium, government duties and concessions.

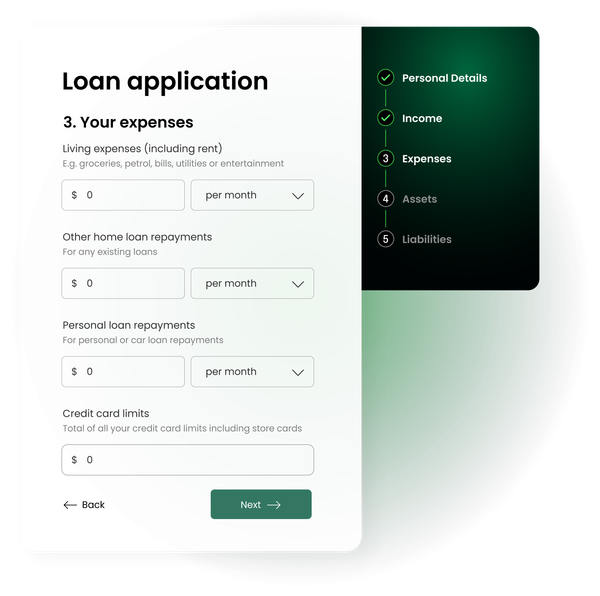

Pre-approval tools

Full configurability for tailored experiences

Use calculator APIs configured to your product and policy requirements. Improve customer experience with calculations backed by data for more accurate assessments.

Multiple Data Types

Improve transparency with customer declared data

Give customers visibility into their financial position and provide greater conversion certainty, and support them through their in-life credit lifecycle.

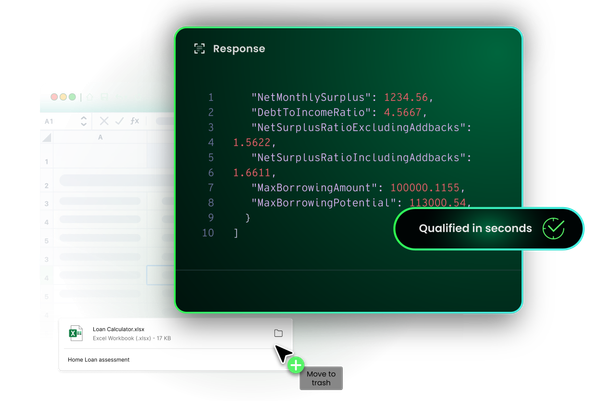

Automation

Save time by removing manual data collection

Remove manual data collection and assessment processes by embedding Xapii Convert's powerful data consolidation and enrichment capability and help customers making important financial decisions.

Security and Encryption

Bank-level security and encryption

We are SOC2 compliant, ISO certified, have embedded digital compliance and are CDR and ADR accredited.

Testimonials