Xapii Decide

Automated decisioning & financial assessments

Powerful, automated, and highly scalable exception-based underwriting platform

Our tech is trusted by:

Decisioning & Financial Assessments

Automated decisioning built to scale

Simplify assessments, improve unit economics, and lower fulfilment costs.

70%

of the digital home loan segment is powered by Xapii including Australia's largest banks and brands

8x

reduction in financial assessment time with automated data collection and decisioning

100+

rules configured to your policy and automatically checked according to your risk appetite

Watch a Demo

Best-in-class automated serviceability decisioning

Xapii Decide combines the benefits of automated collection and enrichment of your customer's financial data with configurable underwriting and decisioning for improved customer experiences, unrivalled efficiency, and decreased cost of origination.

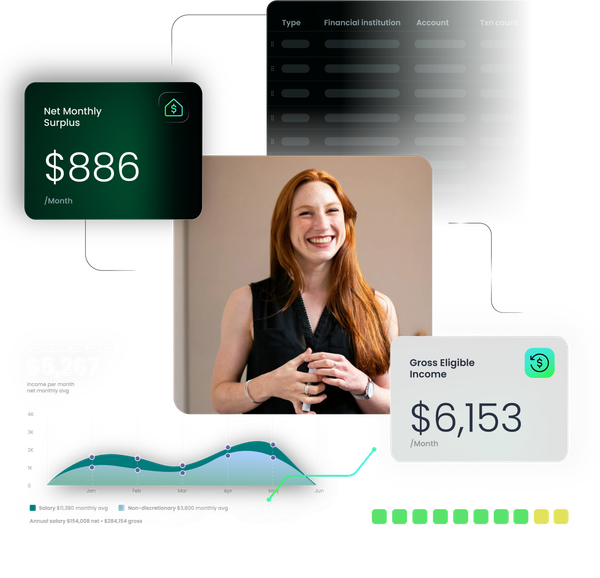

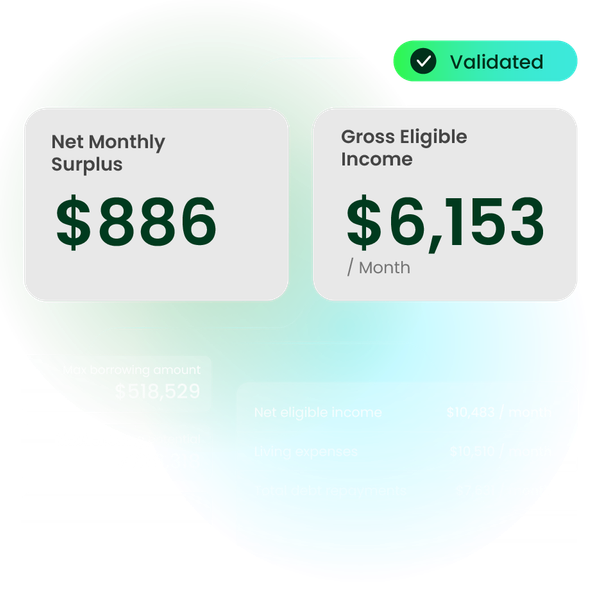

End-to-end financial assessments

Automated serviceability and financial assessments

Xapii Decide automates serviceability decisions through API integration, no-code policy rules, and dynamic financial analysis delivering fast, data-driven results with clear insights.

Data ingestion & Enrichment

All data sources, one platform

Using bank statements, Open Banking, direct account data, payslip or CCR, Xapii Decide automatically processes, verifies, and enriches financial information in seconds.

With 8+ years of model training and millions of transaction data points Xapii Decide is the leading financial assessment platform.

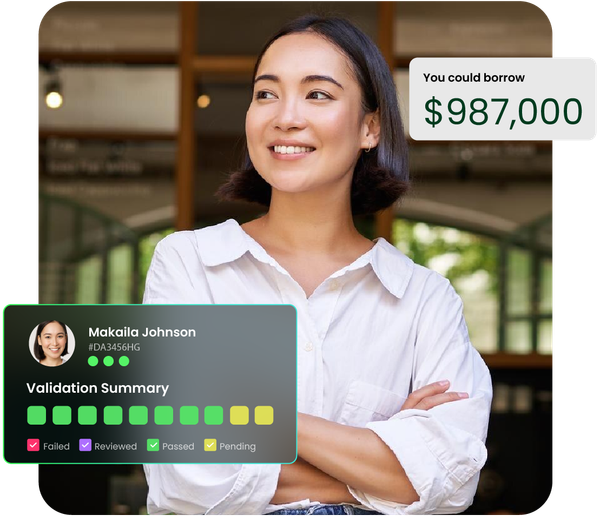

Human-in-the-loop Underwriting

Scale your team's potential with exception-based underwriting

Xapii's human-in-the-loop approach lets your team focus on high-value work by automating routine decisioning and requiring intervention only when needed. This enables continuous AI improvement and maximum throughput, allowing you to scale by exception.

Fraud detection and verification

Stay ahead with AI-powered fraud detection

Xapii Decide's embedded AI fights fraud with comprehensive financial insights and document detection. The platform performs 100+ document fraud checks in seconds, validates ABNs, BSBs, and barcodes, and automatically detects suspicious claim patterns to protect your business.

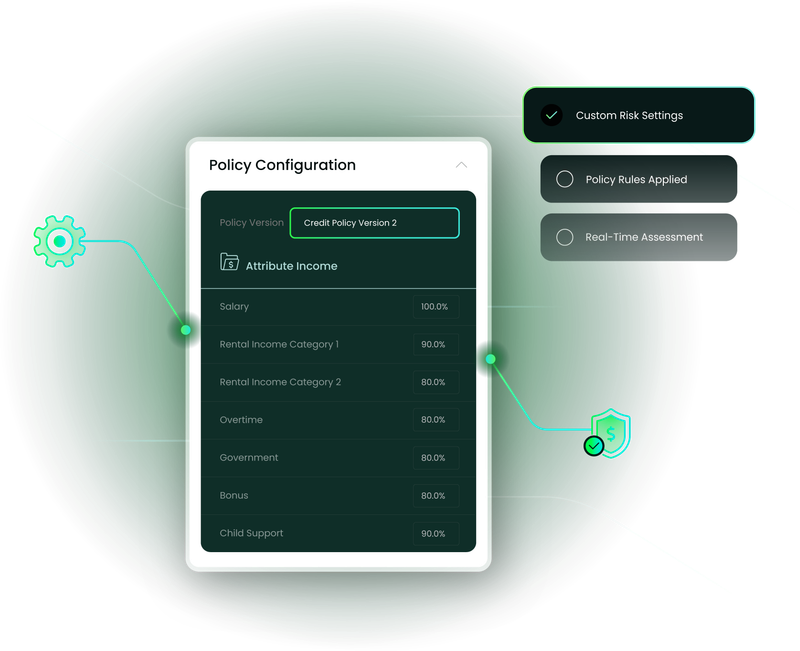

Configurable to your business rules

Control the assessment process

Xapii's highly configurable and parameterised features allow you to configure to your chosen level of risk across multiple policy and risk tolerance rules and settings.

Security and Encryption

Bank-level security and encryption

We are SOC2 compliant, ISO certified, have embedded digital compliance and are CDR and ADR accredited.

Testimonial

See how others use Xapii Decide to grow

Up and Tiimely are very aligned on the need for a balance of automation and great support experiences that have a real person involved. Having fast, self-serving experiences and efficient processes is extremely important to us.

Justin Frech

Chief Operating Officer, Up

Frequently asked question

Still have questions about Xapii Decide?

Is Xapii Decide only for mortgage lending?

No. Xapii Decide can be used in many different industries, not just home loans. Because it’s highly configurable, it supports a wide range of decisioning and assessment needs, including:

Unsecured lending (e.g. personal loans, credit products)

Banking & financial services (e.g. mortgages, consumer loans)

Superannuation (e.g. member checks, financial health checks)

Government (e.g. verifying information, assessing applications)

Insurance (e.g. risk checks, claims assessments)

Xapii Decide’s tools can be adapted to many scenarios beyond mortgages. Learn more about use cases here.

How much does Xapii Decide cost?

Pricing varies based on volume, integration requirements, and business needs. Contact our team to discuss your specific requirements and get a tailored quote.

What data sources does Xapii Decide support?

Xapii Decide supports bank statements, Open Banking, direct account data, payslips, and CCR. The platform processes, verifies, and enriches financial information automatically.

Does Xapii Decide include fraud detection?

Yes. Xapii Decide partners with Fortiro to perform 100+ automated document fraud checks, validates ABNs, BSBs, and barcodes, and detects suspicious patterns in financial data. These checks run in seconds as part of the assessment process.

Does Xapii Decide integrate with CRMs and existing tech stacks?

Yes. Xapii Decide connects to existing systems, CRMs, and workflows through API integrations. Automated assessments and decisioning data flow into your existing systems, maintaining your current processes while adding automated decisioning capabilities.

Do I need technical resources to set up Xapii Decide?

Implementation requires technical resources for API integration. Once set up, the platform uses no-code rules, allowing your credit and risk teams to update policies without developer support. Xapii handles platform maintenance.

How does Xapii Decide handle regulatory changes?

Xapii monitors and updates the platform for regulatory changes. The embedded compliance framework is maintained as regulations evolve.

Get in contact

Ready to see Xapii by Tiimely in action?

Request a demo or get in contact with our team to find out more.