Xapii Features

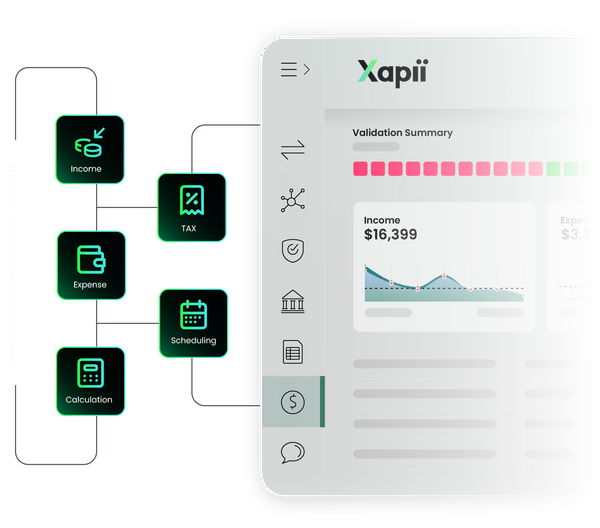

Serviceability assessment and decisioning

Boost accuracy, increase automation for more straight-through processing, and confidently close more deals with Xapii's powerful, AI-driven serviceability engine.

Augment, not replace

Fully configurable serviceability automation

Automate financial validation with explainable AI that scales with your business, ensures compliance, reduces costs, and improves customer experiences.

API-first experience

Access real-time policy-configured serviceability metrics across applications and deals via Xapii's API.No more spreadsheets

Configure and scale your lending automation with Xapii's fully configurable serviceability engine in a secure, auditable environment.Deep dive into financials

Get a complete view of serviceability with detailed financial breakdowns and advanced insights combining monthly outputs and thorough analysis.

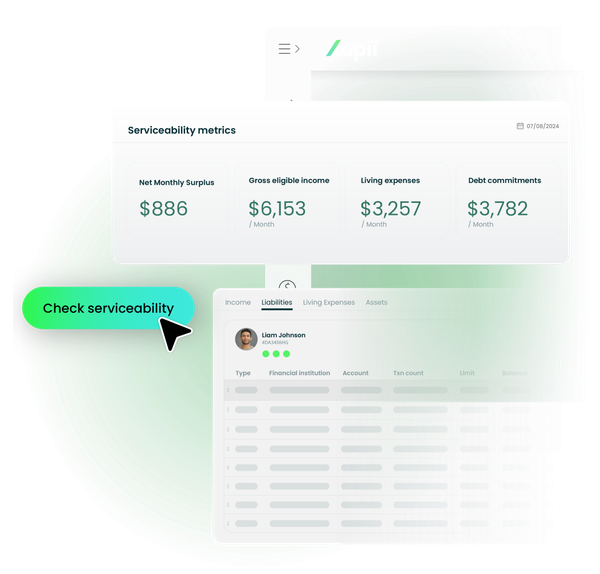

Serviceability Metrics

Instant insights for confident financial decisions

Xapii automatically analyses essential serviceability metrics like net monthly surplus, debt to income ratio, and loan to income ratio, giving you instant clarity on customer financial health. Make faster, more confident lending decisions while reducing manual work and uncovering hidden opportunities.

Pre Built Configuration

Pre-configured architecture for rapid deployment

Start delivering value immediately with Xapii's ready-to-go configuration. We handle the technical details, from managed integrations to automatic updates for tax rates and benchmarks like HEM so your team can focus on serving customers and growing your business.

Business Rules and Policies

Advanced rule configuration for multi-product portfolios

Xapii lets you configure multiple credit policies tailored to your exact business needs—from income type shading based on postcode or property type, to custom calculation logic for investment expenses and tax treatment.

Apply the right policy to the right customer automatically, ensure consistency across your team, and adapt to regulatory changes without manual updates.

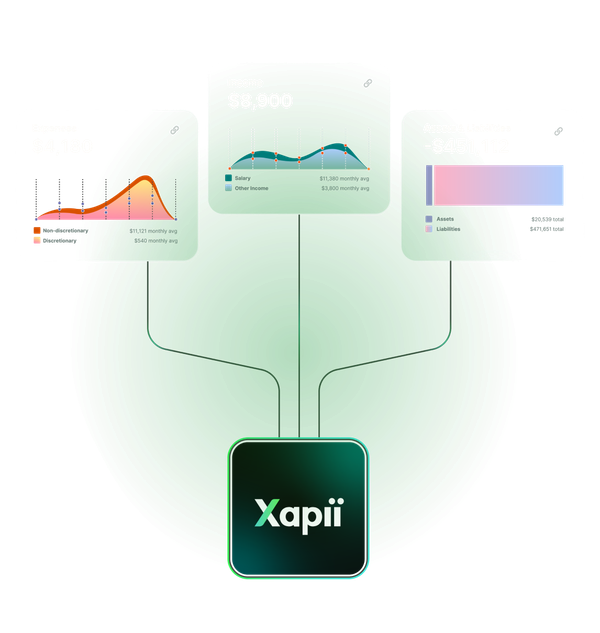

Dynamic Financial Cascade

Use only the data you need with intelligent prioritisation

Xapii automatically selects the most reliable data source available from manually validated figures to auto-validated transactions, Open Banking actuals, or customer declarations. Get accurate assessments faster while reducing unnecessary verification work.

Get in contact

Ready to see Xapii by Tiimely in action?

Request a demo or get in contact with our team to find out more.