Approve with confidence

Scale with accuracy and automation

Deliver quick and accurate creditworthiness, affordability and assessment decisions configured to your risk appetite

Buy Now Pay Later

Automated customer consent, financial position validation, and decisioning solved for BNPL.

Credit Cards

Configured to your lending policy, combined with insights driven by your data.

Consumer Lending

Deliver quick and accurate credit readiness, affordability and assessment decisions configured to your risk appetite.

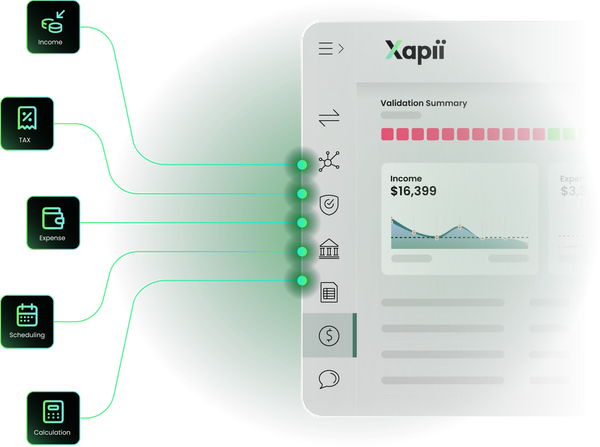

Powered by your data

Data agnostic for seamless scalability

Scale without complex data infrastructure. Timely's data-agnostic approach lets unsecured lenders expand portfolios and adapt to changing credit landscapes. Pull in alternative data sources like open banking and payslip automation to make quicker decisions, sharpen risk assessment, and profitably serve more borrowers.

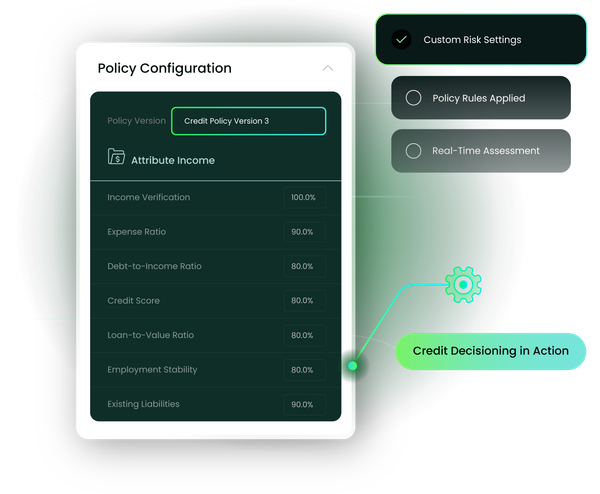

Automated credit decisions

AI-powered credit decisioning that scales with your business

Build sophisticated credit strategies without the overhead. Timely's rules engine lets you set income and expense validation criteria, automating loan decisions based on your risk appetite. Lower operational costs, speed up turnaround times, and serve more borrowers without scaling your team.

Fully configurable rules

Integrate with Australia's trusted credit bureaus and configure credit calls based on your business needs and risk appetite.Data source agnostic

Bring together disparate sources of data for real-time access to lending decisioning and actionable insights, so your team can act with confidence.Consistent compliance

Stay ahead of legislative requirements and ensure all decisions are auditable.

Why partner with Tiimely

Data & explainable AI

Our platform harnesses the power of data & explainable AI to enable human in the loop automation throughout.

Seamless integration

Xapii slots into your existing tech stack and ingests data from Australia's most trusted sources.

API enabled

Our APIs offer extensibility & flexibility. When our partners integrate it leads

to higher customer engagement & lower operating costs.Configurability

The platform's configurability & flexible design enable support for a wide range of use cases.

Componentisation

The platform’s modular approach ensures flexibility and efficiency in execution.

Resilience

Our platform proactively prevents, detects, recovers & responds to events that could disrupt business activities.

Info security & compliance

Info security & proactive monitoring of environmental controls enables compliance by design.

Quality engineering

Quality is reflected in the Platform through adherence to industry best practices & continuous improvement.