Our tech is trusted by:

Powered by intelligent automation

Underwrite faster, smarter, and more efficiently

Exception-based underwriting that gives you a competitive advantage

Win more business while reducing risk

Automate routine decisions so your underwriters can focus on complex, high-value cases.

Make smarter decisions faster

Real-time data and contextual insights at the point of decision reducing turnaround times from days to minutes.

Deliver consistent results at scale

Machine learning applies your best underwriting practices to every decision, maintaining quality even during peak volumes.

End-to-end mortgage solutions

Solutions for every part of the home loan journey

Tiimely’s API-powered and modularised platform, Xapii, integrates seamlessly with new and existing tech stacks.

Leverage Xapii to increase customer conversion and reduce cost while creating a home loan application experience your customers will love.

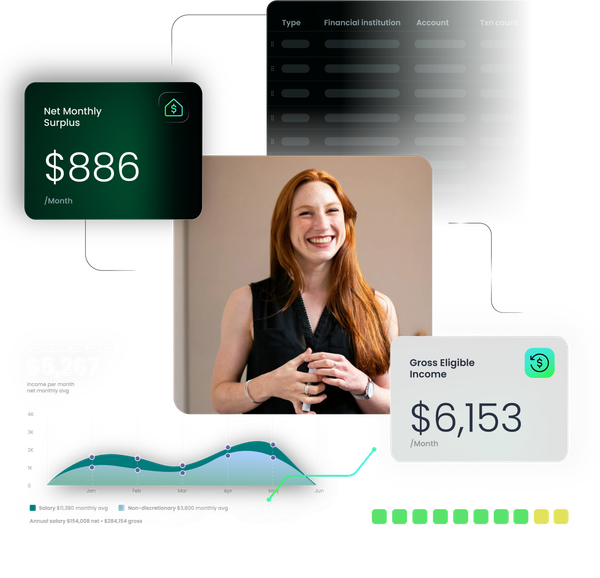

Xapii Decide

Automated decisioning & financial assessments

Powerful, automated, and highly scalable exception-based underwriting platform built for lending.

- Securely validate your customers' financial position in an instant

- Configure to your policy to automate financial decisioning

- Automatically digitise and enrich financial data

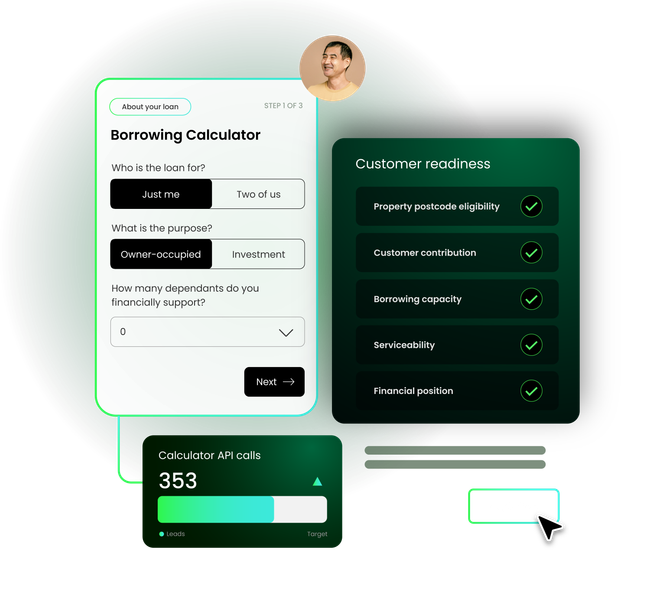

Xapii Convert

Turn more visitors into approved borrowers

Embed interactive calculators and instant pre-qualification tools directly into your website.

- Grow volumes: Fill your funnel with quality leads

- Reduce drop off: Support customers through their credit journey

- Lower costs: Automated validation and policy checks

White label lending

Go-to-market with our fully managed white-label product

Everything you need to launch a digital mortgage product in market from application to settlement to customer support.

Why partner with Tiimely

Data & explainable AI

Our platform harnesses the power of data & explainable AI to enable human in the loop automation throughout.

Seamless integration

Xapii slots into your existing tech stack and ingests data from Australia's most trusted sources.

API enabled

Our APIs offer extensibility & flexibility. When our partners integrate it leads

to higher customer engagement & lower operating costs.Configurability

The platform's configurability & flexible design enable support for a wide range of use cases.

Componentisation

The platform’s modular approach ensures flexibility and efficiency in execution.

Resilience

Our platform proactively prevents, detects, recovers & responds to events that could disrupt business activities.

Info security & compliance

Info security & proactive monitoring of environmental controls enables compliance by design.

Quality engineering

Quality is reflected in the Platform through adherence to industry best practices & continuous improvement.

Case studies

We’ve partnered with brands you know and love

Up and Tiimely are very aligned on the need for a balance of automation and great support experiences that have a real person involved. Having fast, self-serving experiences and efficient processes is extremely important to us.

Justin French

Chief Operating Officer, Up