Solutions

See how Tiimely supports insurance

Identify insurance fraud in claims

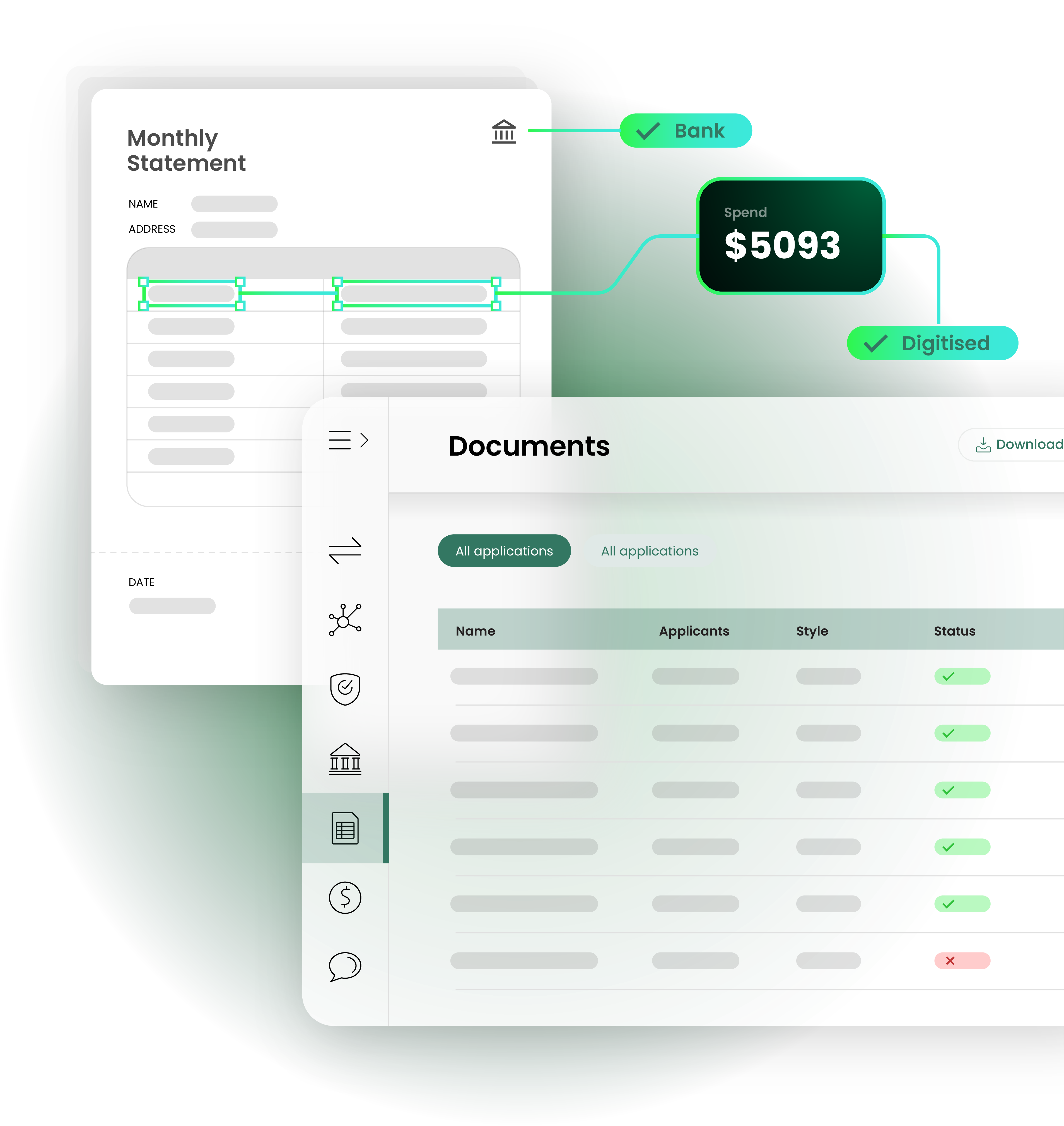

Xapii offers secure document collection which uses AI to analyse 100+ different fraud checks to identify evidence of document tampering or manipulation in real time.

Drive growth with deeper insights

Leverage transaction data, open banking, and Tiimely's proprietary AI to identify opportunities for policy consolidation or analyse potential claim behaviours to enable risk based pricing.

Automate complex calculations with AI

Xapii's highly configurable and parameterised features allow you to configure rules to your chosen level of risk and tolerance.

Features

Features tailored to insurance needs

Insurance underwriting

Unlock deeper financial insights

Xapii enables deeper insights into a customer's financial data available through the Consumer Data Right as part of the Australian open banking regime.

These insights can be used during analysis and risk profiling to support the underwriting process.

- Surface financial risk indicators such as high-risk spending or irregular income

- Identify additional insurance policies for bundling opportunities and nudging

- Unlock dynamic pricing and risk modelling using merchant data information

Fraud detection

Reduce insurance fraud with AI-powered document analysis

Xapii’s embedded AI and tools help to fight fraud through financial insights and document fraud detection.

- Instantly run 100+ fraud checks on uploaded documents

- Gain in-depth transaction analysis to identify repeated claims or conflicting data

- Enhanced digital analysis that investigates document forensic history and validates content such as ABNs, barcodes, and BSBs

- Automate income assessments for claims processing

Why partner with Tiimely

Data & explainable AI

Our platform harnesses the power of data & explainable AI to enable human in the loop automation throughout.

Seamless integration

Xapii slots into your existing tech stack and ingests data from Australia's most trusted sources.

API enabled

Our APIs offer extensibility & flexibility. When our partners integrate it leads

to higher customer engagement & lower operating costs.Configurability

The platform's configurability & flexible design enable support for a wide range of use cases.

Componentisation

The platform’s modular approach ensures flexibility and efficiency in execution.

Resilience

Our platform proactively prevents, detects, recovers & responds to events that could disrupt business activities.

Info security & compliance

Info security & proactive monitoring of environmental controls enables compliance by design.

Quality engineering

Quality is reflected in the Platform through adherence to industry best practices & continuous improvement.