Automotive lending automation

Frictionless automotive lending journeys

Build customer-centric lending journey's with a focus on transparency, efficiency, and conversion

AI-powered credit decisioning

Digitise your credit policy for automated credit decisioning and loan fulfilment.

Out-of-the-box integrations

Integrate with some of Australia’s biggest and most trusted data sources for fast and accurate serviceability assessment.

Automated data ingestion

Combine your data with Tiimely’s enrichment and insights capabilities to unlock business growth.

Auto finance solution

Smarter lending for automotive businesses

Streamline your auto finance operations with integrated calculators and pre-approval tools that capture high-quality leads. Xapii automates lending decisions by validating affordability across multiple data sources while seamlessly integrating with your existing systems to accelerate every application from submission to approval.

Funnel performance

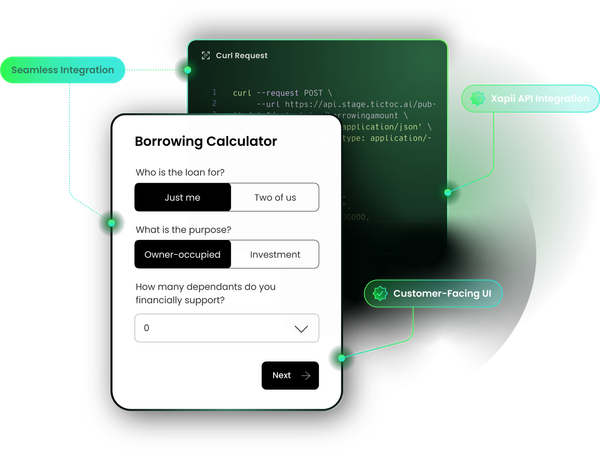

API-led enhanced customer journeys

Deploy a range of easy-to-integrate calculators including repayment, refinance savings, upfront costs, and borrowing power that help customers explore their options.

Use unique pre-approval and true borrowing capacity tools that leverage the serviceability engine to nurture prospects and qualify leads before they apply.

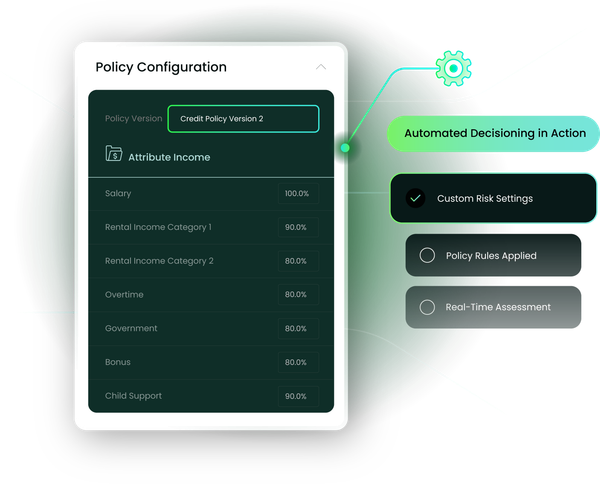

Streamlined decisioning

Automate your decisioning workflow

Simplify lending assessment and reduce unit economics with automated decisioning configured to your product and policy requirements.

Access results in real-time through secure UI or API connections. Annotate and amend automation outputs if required to accelerate approvals and keep applications moving.

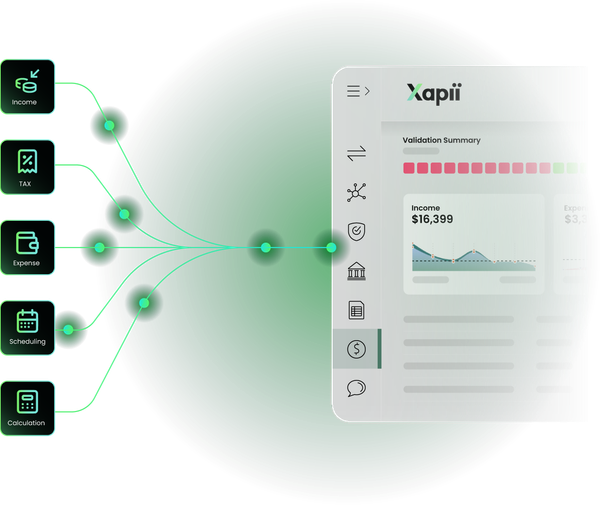

Data validation and serviceability

Automate credit assessment wth confidence

Xapii automatically enriches and categorises income, expenses, liabilities and assets from any data source to build a complete financial picture. Configure your serviceability rules to match your lending criteria, then connect directly to your existing CRM or workflow to manage applications.

Why partner with Tiimely

Data & explainable AI

Our platform harnesses the power of data & explainable AI to enable human in the loop automation throughout.

Seamless integration

Xapii slots into your existing tech stack and ingests data from Australia's most trusted sources.

API enabled

Our APIs offer extensibility & flexibility. When our partners integrate it leads

to higher customer engagement & lower operating costs.Configurability

The platform's configurability & flexible design enable support for a wide range of use cases.

Componentisation

The platform’s modular approach ensures flexibility and efficiency in execution.

Resilience

Our platform proactively prevents, detects, recovers & responds to events that could disrupt business activities.

Info security & compliance

Info security & proactive monitoring of environmental controls enables compliance by design.

Quality engineering

Quality is reflected in the Platform through adherence to industry best practices & continuous improvement.