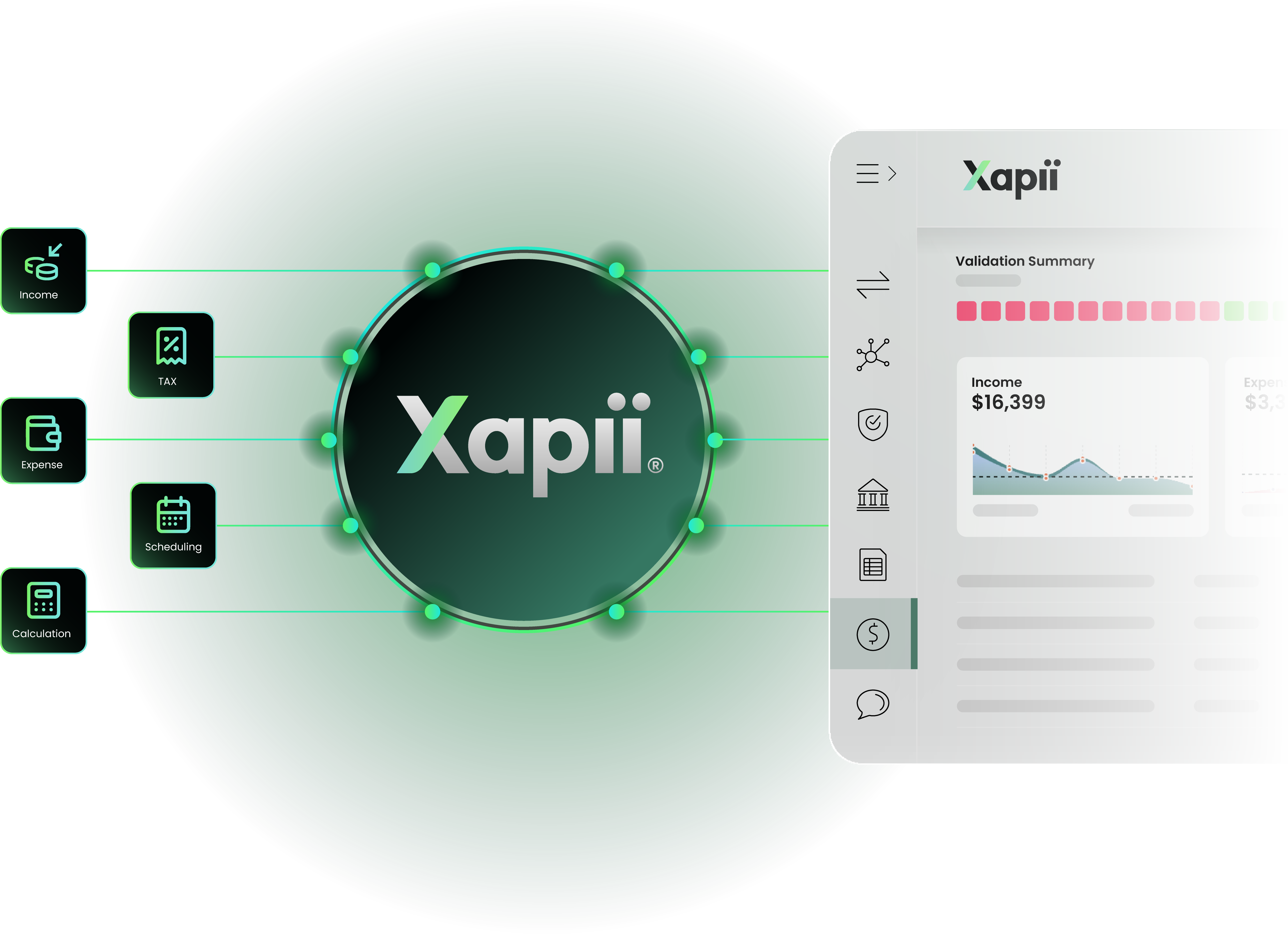

Xapii Features

Data consolidation and enrichment

Streamline your financial assessment capabilities with Xapii's unique data collection and enrichment model.

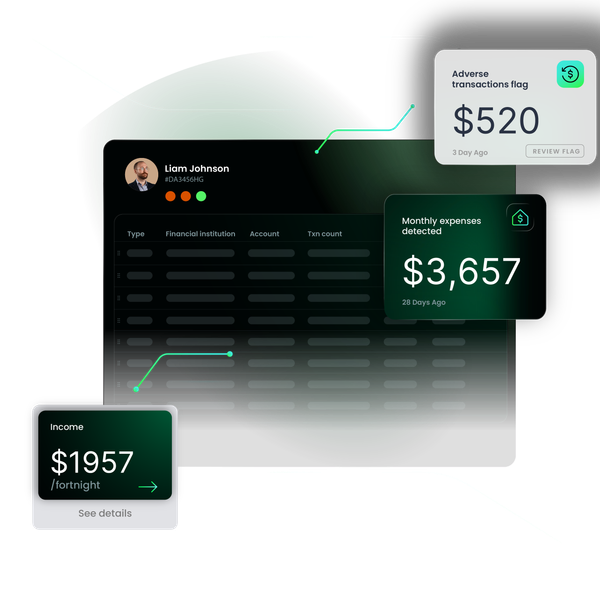

Full Financial Picture

Transform raw financial data into actionable insights

Create a single source of truth for customer's financial data and unlock deep insights into their financial position.

One platform, numerous ways to ingest data

Xapii supports Open Banking, common data aggregation providers, statement OCR, CDR, declared financials, BYO account and transaction data.Enriched data ready for action

Data is enriched with 8+ years and hundreds of millions of transaction data points, ready for Xapii’s automated assessment.Interact with results

Enable your team to interact with the enriched results, and let Xapii machine learning reduce the need for manual validation.

Data collection sources

Collect data at every point of the journey

Xapii’s proprietary platform is purpose-built to deliver affordability and serviceability decisions. Retrieve data on behalf of consumers via consented pathways, provide secure document upload links, and manage integrations with third parties.

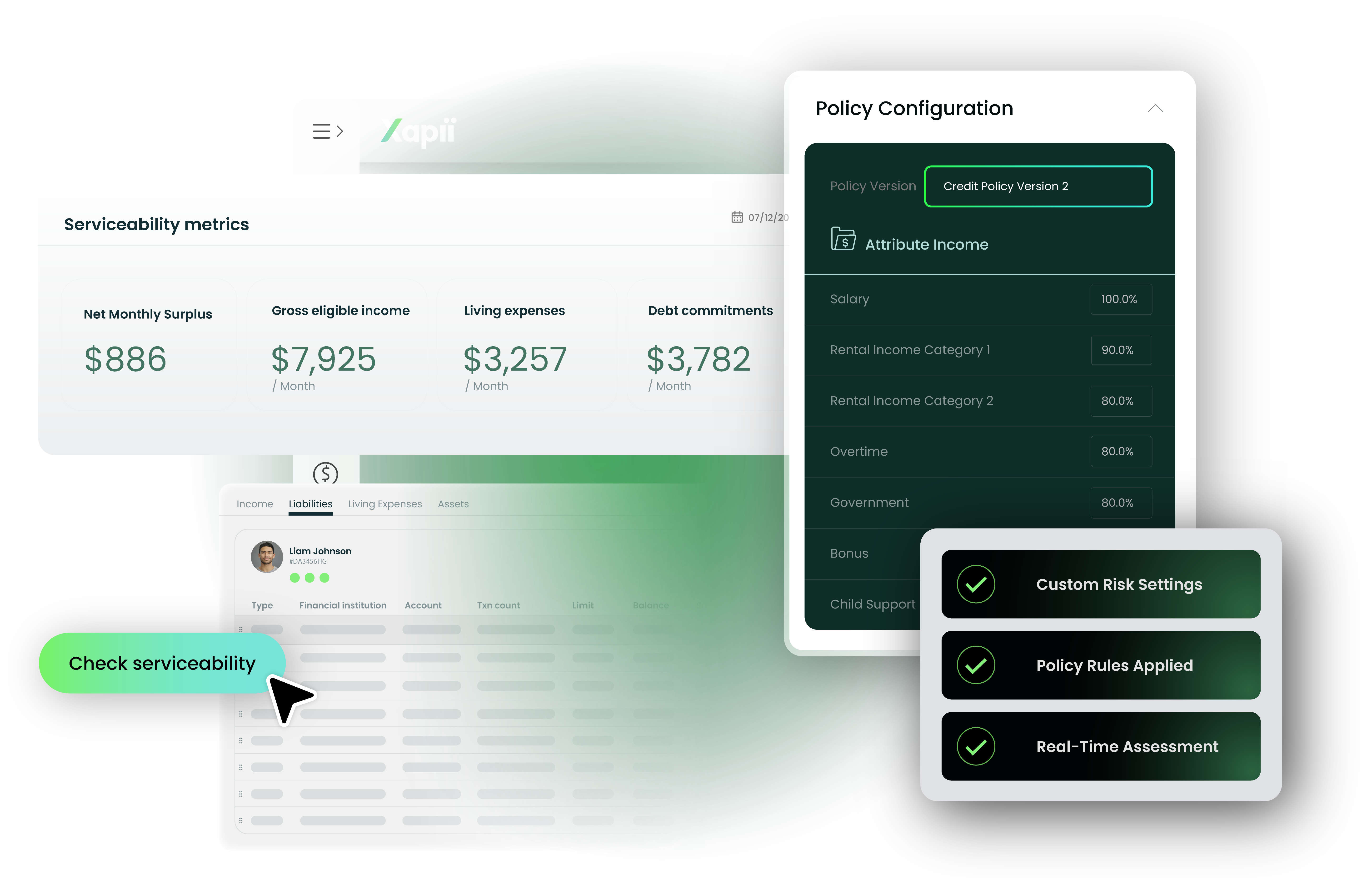

Data Enrichment Approach

Deliver powerful enrichment of data beyond categorisation

Xapii identifies and aggregates multiple data sources and calculations to standardise datasets and deliver deeper insights into a customer's financial positioning.

Data Detection Approach

Leverage enriched data for seamless automated results

Configure rules to detect and validate a customer's income and expense regularity, debt balances, adverse transactions, and more to assess with confidence.

Get in contact

Ready to see Xapii by Tiimely in action?

Request a demo or get in contact with our team to find out more.