Xapii Convert

Turn potential customers into approved borrowers

Integrate intuitive tools and calculators for powerful conversion-led experiences across a customer's credit lifecycle

Our tech is trusted by:

Enhanced Customer Experiences

Powering credit journeys that convert

Increase meaningful funnel conversion and scale with ease

70%

expansion for top of funnel with quality leads aided by our tools

45%

uplift in 'approval' conversions by better supporting customers through their credit journey

20%

decrease in average cost to serve for 'approved' deals with automated serviceability and policy checks

Watch a Demo

Frictionless experiences for customer-focused businesses

Xapii Convert enables you to leverage serviceability and calculator APIs within your customer experiences. Seamlessly integrate existing webforms or CRMs to drive AI-powered financial assessments.

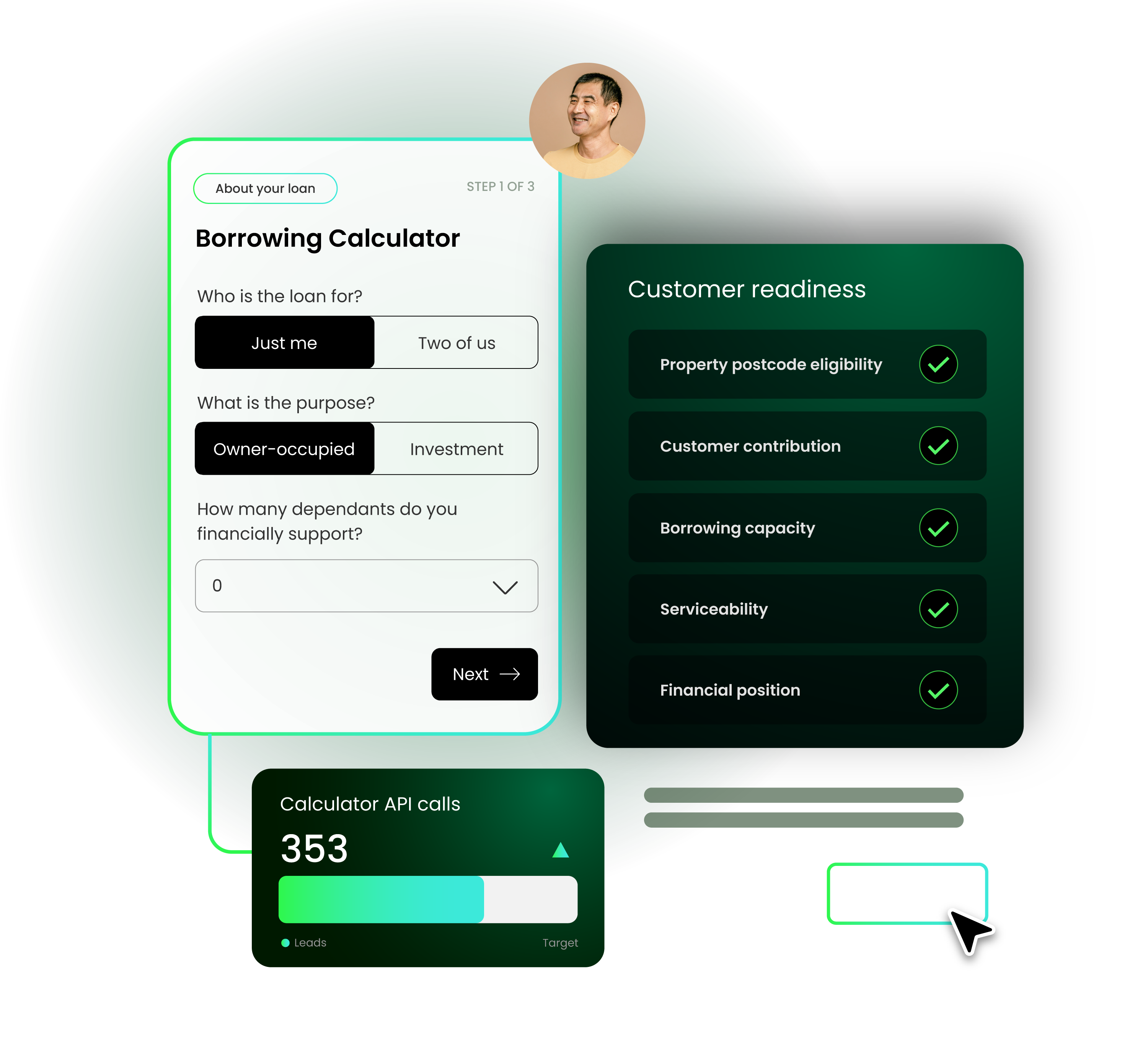

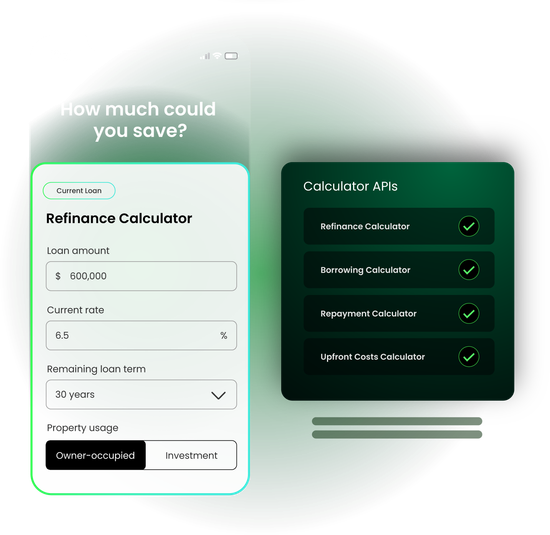

Financial Calculators

A wide range of financial calculator APIs

Drive exceptional customer experiences with a suite of hardened calculator APIs including repayment, refinance savings, upfront costs and borrowing power used by some of Australia’s biggest brands.

Configurable tools

Configurable to your risk appetite

Configure Xapii Convert calculator APIs and tools to your business rules and risk appetite to provide your customers with a seamless and transparent experience while improving funnel performance.

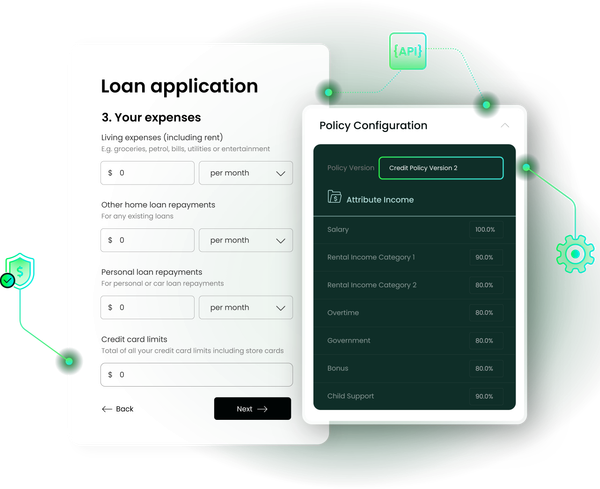

Integrations

Build out your loan application journey through open APIs

Effortlessly integrate Xapii Convert to your existing digital technologies such as webforms, CRMs or workflows to capture serviceability metrics or financial assessments using customer declared financials.

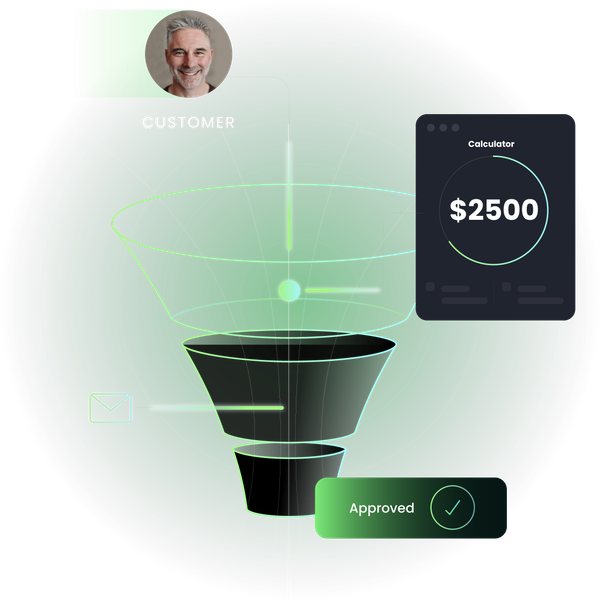

Customer Led Conversion

Convert enquiries into quality leads and applications

Build engaging credit journeys that guide customers through affordability checks or approval in principle to help them understand commitments before they're ready to apply.

Security and Encryption

Bank-level security and encryption

We are SOC2 compliant, ISO certified, have embedded digital compliance and are CDR and ADR accredited.

Testimonial

See how others use Xapii Convert to grow

For our launch, it was important to find an Australian partner who had an easy to integrate serviceability assessment solution. Once we saw the demo, Xapii Convert by Tiimely was an easy decision due to its real-time assessment analysis, simple interface and local support team.

Ben Kassel

Chief Executive Officer, Sloop It

Frequently asked question

Still have questions about Xapii Convert?

Is Xapii Convert just calculator APIs?

Xapii Convert goes beyond calculators. While it includes a suite of hardened financial calculator APIs, it’s designed to support credit journeys that convert.

How much does Xapii Convert cost?

Pricing is tailored to your volume, integration needs, and business requirements. Reach out to our team for a consultation and we'll work with you to create a quote.

Does Xapii Convert integrate with CRMs?

Yes. Xapii Convert integrates with your existing CRM and webforms through APIs. You can seamlessly connect to capture serviceability metrics and financial assessments using customer declared financials, ensuring data flows directly into your workflows.

How does Xapii Convert fit into our existing tech stack?

Xapii Convert integrates effortlessly with your existing digital technologies through open APIs. Connect it to your webforms, CRMs, or workflows to capture serviceability metrics and financial assessments.

Can Xapii Convert be configured to match our risk appetite?

Yes. Xapii Convert can be configurable to your business rules and risk appetite ensuring consistent results as you scale.

Can Xapii Convert be customised to match our brand?

Yes. You build the UI for Xapii Convert, giving you complete control over the brand experience. The APIs integrate seamlessly into your website or application with your branding, creating a consistent credit journey for your customers.

Get in contact

Ready to see Xapii by Tiimely in action?

Request a demo or get in contact with our team to find out more.