Hardship Prevention

Guide customer's through hardship

Let Xapii assist with hardship data consolidation, case management and prevention

Consolidate

Digitise the process of collecting and assessing data so your team can focus on providing assistance to your customers when they need it most.

Manage

Inform customer payment plans with real-time data syncing and ongoing financial position and serviceability assessment.

Prevent

Assist customers through hardship to regain net positive financial positioning and offer ongoing monitoring tools so they feel secure and you can track progress.

Support customers

Supporting your hardship team

With regulators and businesses prioritising easier hardship notice and personalised support, Xapii's automated assessment technology enables quick, tailored responses and plans making hardship management both efficient and empathetic.

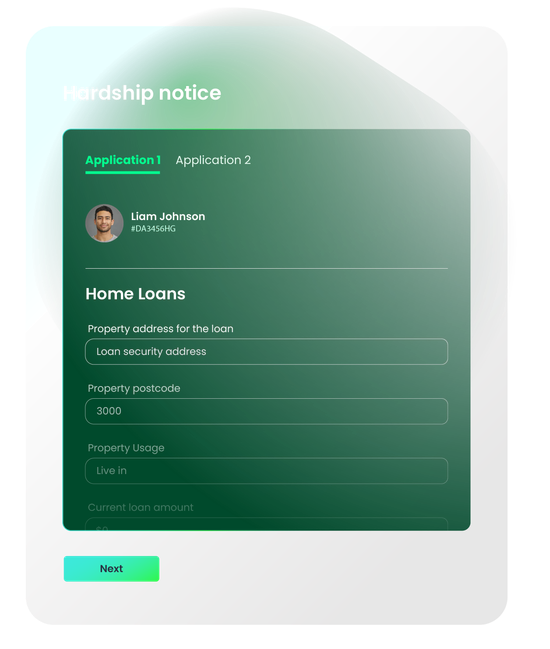

Digitise Hardship Journeys

Digitise your hardship application processes

Xapii collects and aggregates multiple data sources and calculations to standardise your datasets and deliver deeper insights into a customers financial positioning.

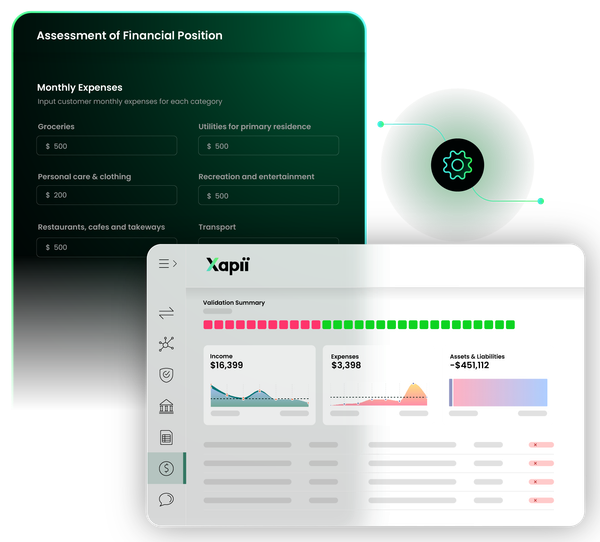

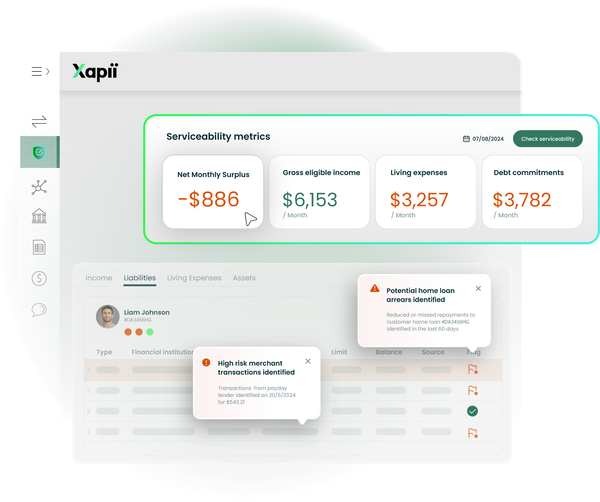

Automated Hardship Assessments

Serviceability and affordability checks for hardship assessments

Configure Xapii to your serviceability and affordability requirements or other business rules to seamlessly assess hardship applications. Use declared, detected, and validated financial data to meet regulatory requirements.

Analyse Financial Decisions

Inform customer payment plans with financial positioning insights

Xapii automatically detects, categorises and enriches income, expenses, liabilities and assets validating them against declared financials. Model and test customer payment scenarios in real-time with our built-in serviceability engine.

Prevent Hardship

Make informed decisions towards mitigating financial hardship

Embed Xapii Convert to unlock workflow optimisation, and inform customer payment plans through digitisation and automated serviceability and affordability assessments.

Augment with Xapii Decide to access advanced data consolidation, enrichment and validation capability for true, real-time customer financial position.

Resource Download

Navigating Financial Hardship in Australia guide

See ASIC hardship insights, key lending principles, and Xapii's technology solutions.

Why partner with Tiimely

Data & explainable AI

Our platform harnesses the power of data & explainable AI to enable human in the loop automation throughout.

Seamless integration

Xapii slots into your existing tech stack and ingests data from Australia's most trusted sources.

API enabled

Our APIs offer extensibility & flexibility. When our partners integrate it leads

to higher customer engagement & lower operating costs.Configurability

The platform's configurability & flexible design enable support for a wide range of use cases.

Componentisation

The platform’s modular approach ensures flexibility and efficiency in execution.

Resilience

Our platform proactively prevents, detects, recovers & responds to events that could disrupt business activities.

Info security & compliance

Info security & proactive monitoring of environmental controls enables compliance by design.

Quality engineering

Quality is reflected in the Platform through adherence to industry best practices & continuous improvement.