Xapii by Tiimely

Automate Financial Assessment and Credit Decisioning

Powerful, automated, and highly scalable exception-based underwriting platform built for lending, and beyond

Our tech is trusted by:

What is Xapii?

Scale your lending operations with Xapii by Tiimely

Xapii allows you to combine the benefits of automated collection and enrichment of your customer's financial data with configurable underwriting for unrivalled efficiency and decreased cost of origination.

8x

Faster application processing means faster approvals

70%

Of Australia's digital home loan segment goes through our platform

100+

Policy rules configured to your assessment process and credit risk

Data Ingestion & Enrichment

All data sources, one platform

Bank statements, Open Banking, direct account data, however customers provide financial information, Xapii automatically processes, verifies, and enriches it in seconds.

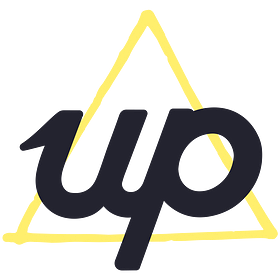

Assessment

Automatically apply your lending criteria

Configure income thresholds, debt ratios, employment rules. Xapii applies them consistently to every application and flags exceptions for human review.

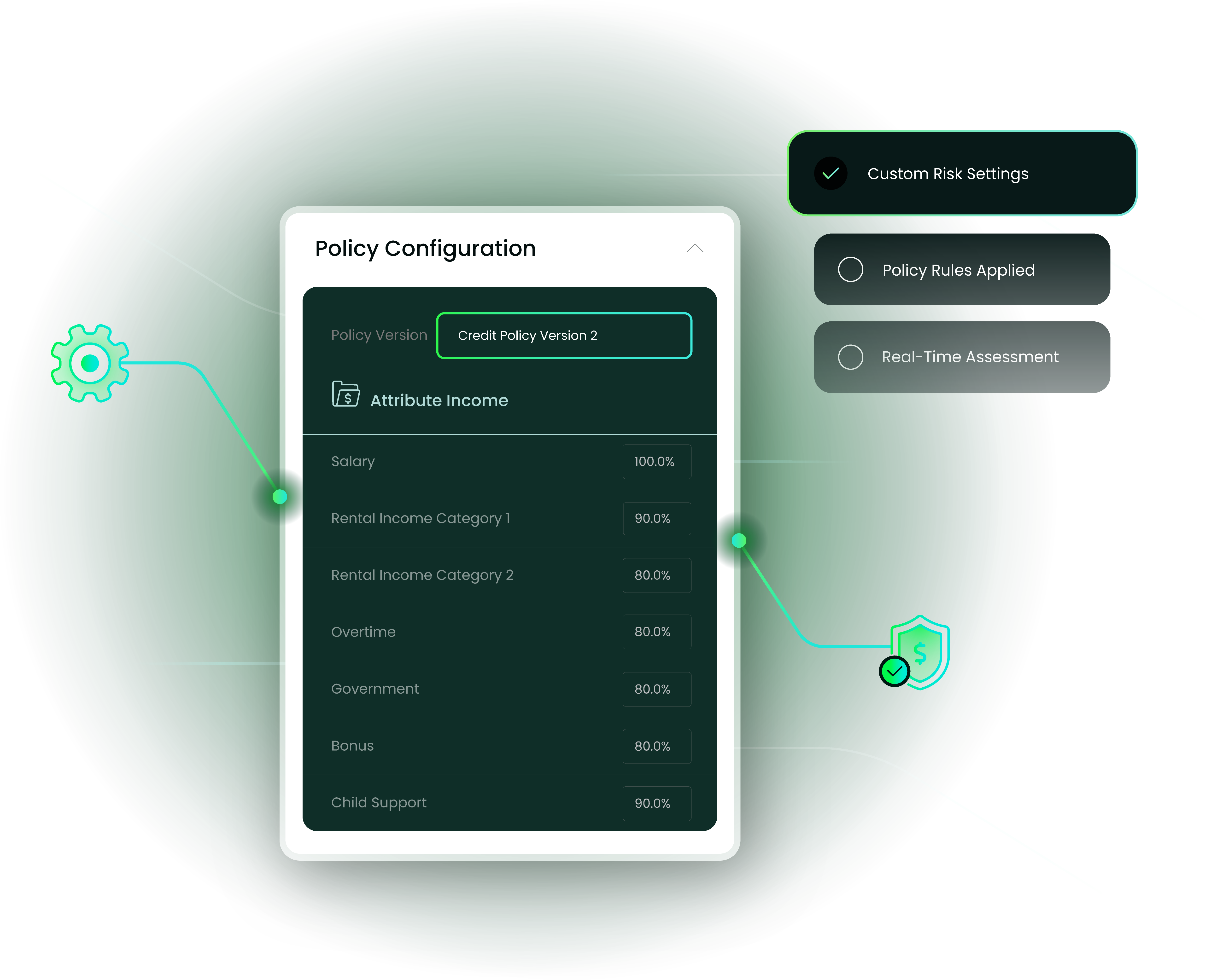

Full Customer Journey

Serviceability & affordability in one view

Complete financial assessment showing true customer capacity. Income, expenses, obligations all documented and auditable for regulatory requirements and customer inquiries.

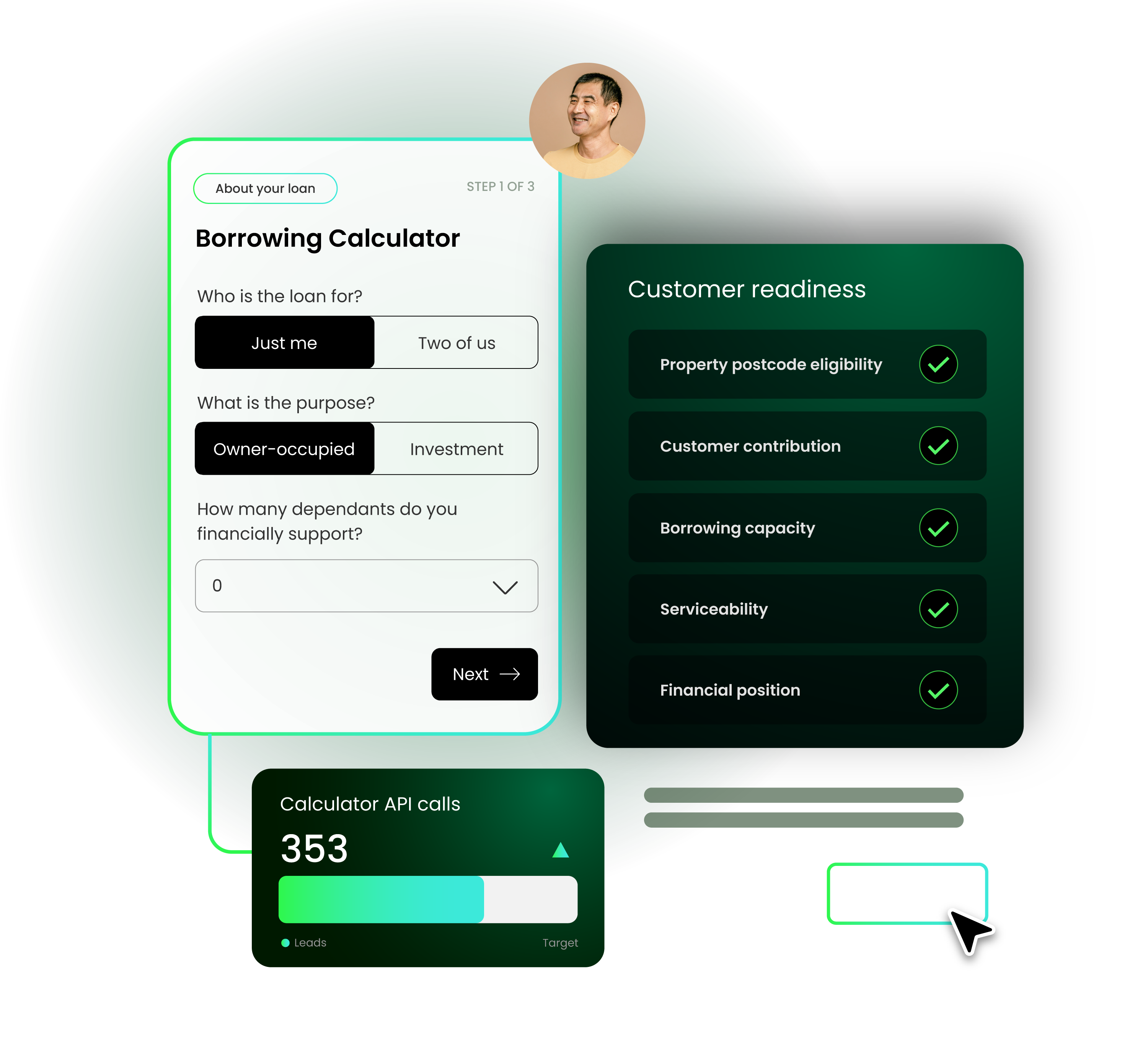

Turn more visitors Into approved borrowers

Embed interactive calculators and instant pre-qualification tools directly into your website.

- Grow volumes: Fill your funnel with quality leads

- Reduce drop off: Support customers through their credit journey

- Lower costs: Automated validation and policy checks

Security and Encryption

Bank-level security and encryption

We are SOC2 compliant, ISO certified, have embedded digital compliance and are CDR and ADR accredited.

Testimonials

Customer success stories

Get in contact

Ready to see Xapii by Tiimely in action?

Request a demo or get in contact with our team to find out more.