Xapii integration: Enhancing document fraud detection with Fortiro

Xapii by Tiimely now integrates with Fortiro to enhance document fraud detection for financial assessments.

October 20, 2025

Release

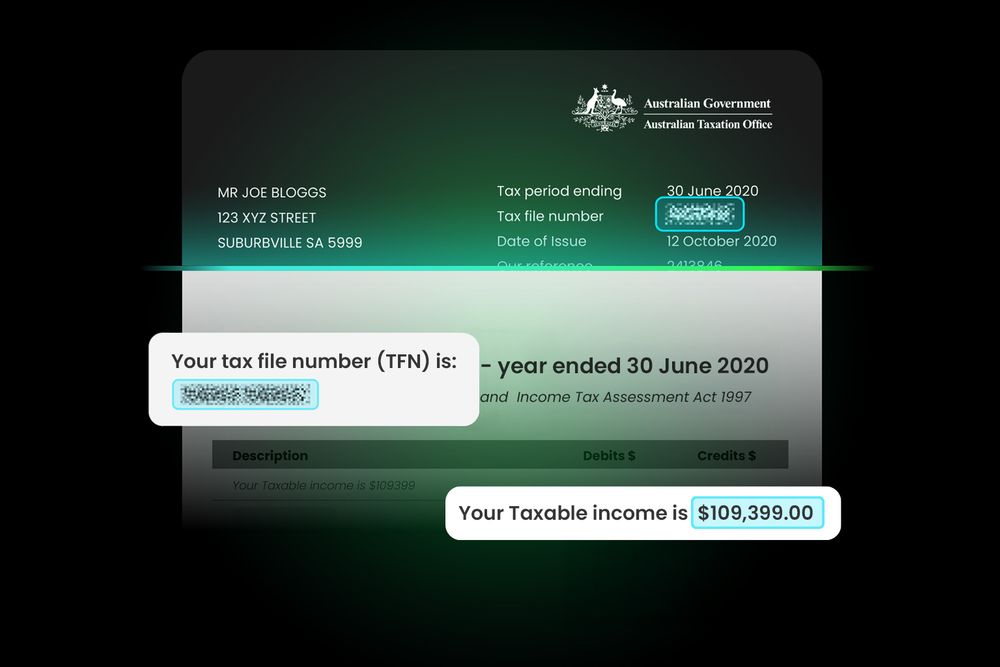

Fortiro is a leader in document fraud detection, trusted by Australia's most prominent financial institutions to detect document fraud and automate income verification based on documents such as payslips.

Now, Fortiro integrates into Xapii by Tiimely, enhancing document fraud detection capabilities within financial assessments. This integration brings together Xapii's comprehensive data ingestion and enrichment capabilities with Fortiro's cutting-edge fraud detection, creating a seamless, powerful solution for lenders who need to scale without compromising on risk management.

Growth and Speed vs Risk: The Lender's Dilemma

Every lender faces competing pressures that seem impossible to balance. On one side, there's the drive for growth and speed while customers expect better experiences, faster outcomes, and hyper-personalised propositions. On the other side sits risk, where fraud is becoming more sophisticated, regulatory scrutiny on financial crime and responsible lending continues to intensify, and comprehensive risk assessment is essential to growth.

The traditional approach forced lenders to choose between moving fast and accept higher risk, or slow down for thorough checks and lose competitive edge. Manual processes, time-consuming document verification, and disconnected systems made it nearly impossible to excel at both.

This integration changes that equation. By combining automation with advanced technology, data, and AI, lenders can deliver speed without sacrificing security.

The Scale of the Problem

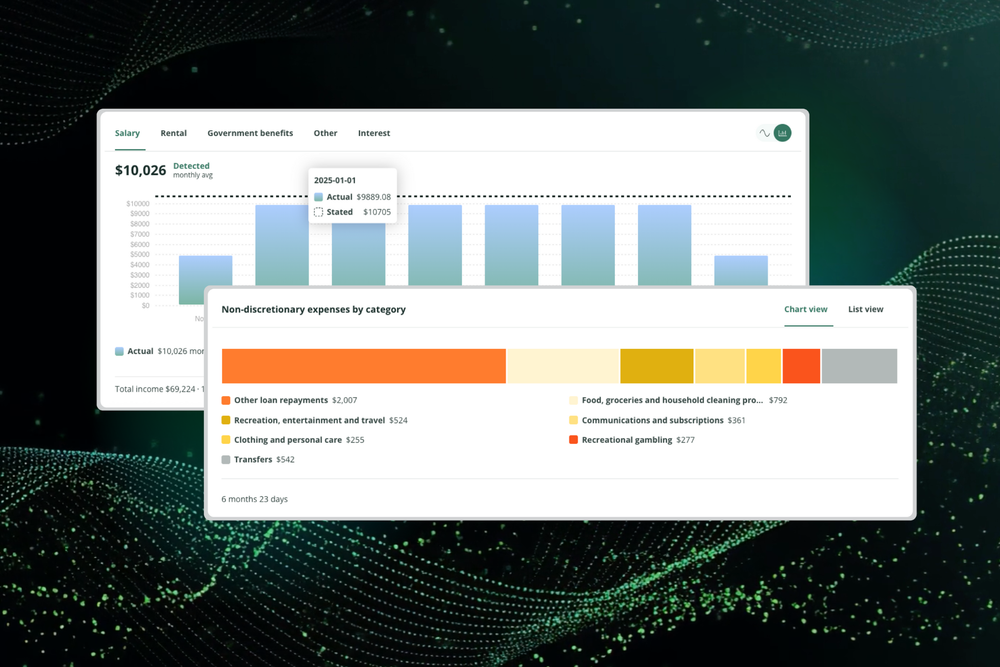

84% of fully submitted loan applications through Xapii include some form of customer documentation, of those applications:

- 64% include payslips for income verification

- 3% of documents in conditionally approved applications show confirmed fraud

That 3% might not sound like much, but adds up fast when processing thousands of applications.

AI-generated fake payslips are now so convincing that even experienced loan officers struggle to spot them.

How the integration works

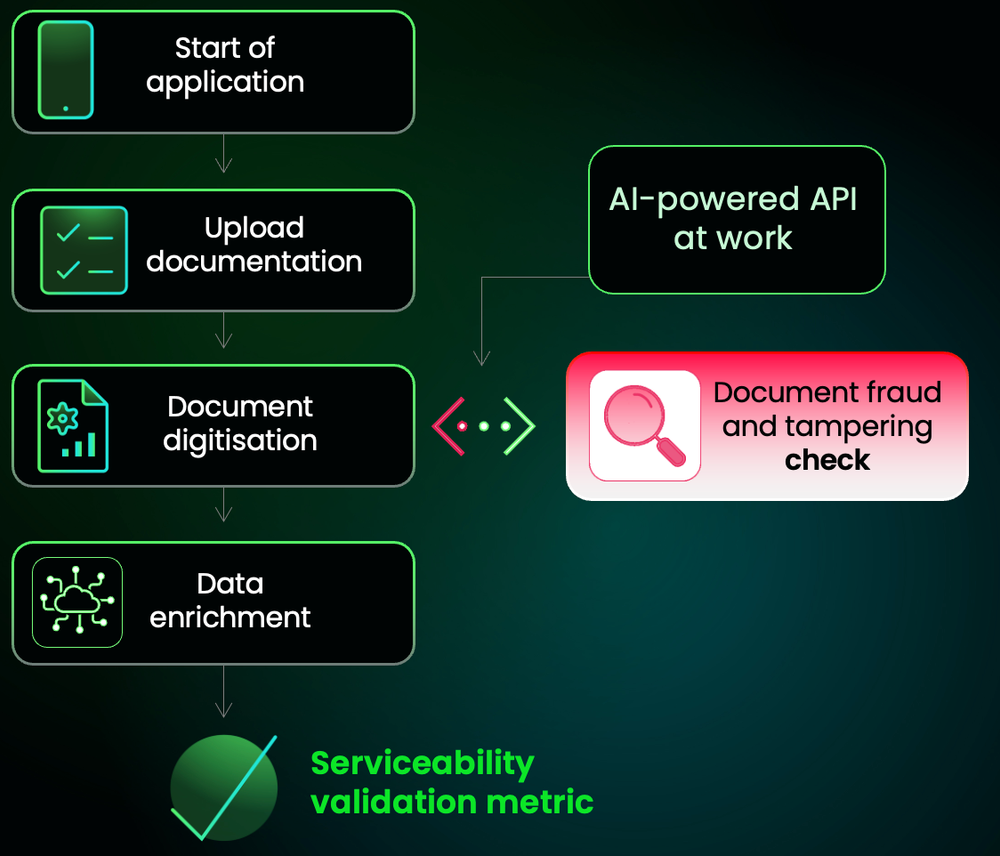

- Integration happens through APIs: No more working across multiple platforms with individual logins

- Applicant documentation gets digitised: Data is ingested, digitised, and standardised from financial documents

- Xapii passes documents to Fortiro: Over 100 automated fraud and tampering checks are triggered immediately

- Fortiro returns fraud check results: Flagging possible fraud or document tampering

- Xapii handles data enrichment: Pulling financial data from other sources to complete the picture

- Financial assessments performed: Xapii takes all data and automatically performs financial assessments and decisioning

What Makes This Integration Powerful

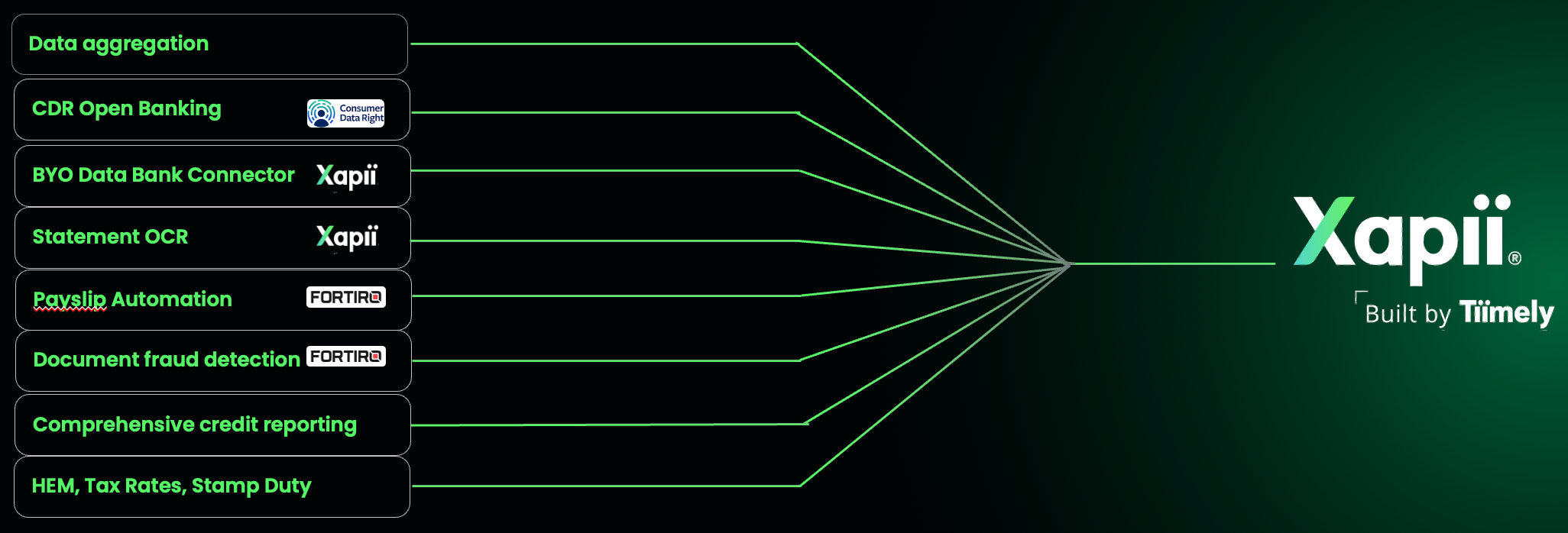

Xapii by Tiimely acts as the consolidated hub, the single source of truth that brings everything together. It handles the data collection from multiple sources including CDR Open Banking, bank connectors, and statement OCR. It digitises and standardises complex financial documents, then enriches that data by pulling information from various financial sources.

Fortiro adds an enhanced level of risk management. Once Xapii passes documents through, Fortiro's AI-driven fraud detection gets to work with 100+ multi-layered checks that adapt to every type of document, including screenshots, scans and images, such as:

- AI-powered layout anomaly detection that spots irregularities in document structure

- Natural language processing to identify inconsistencies in content and phrasing

- Golden template comparison matching documents against known legitimate versions

- Metadata profiling and clustering to identify unusual file properties and manipulation

- Hidden layers or object detection uncovering elements invisible to the human eye

- Pixel-level anomaly detection using AI to spot tampering at the most granular level

Growth Without the Growing Pains

What this integration delivers:

- Better customer experiences: Faster processing, less friction, fewer follow-up requests

- Reduced time to outcome: What used to take hours now takes minutes

- Hyper-personalised propositions: Comprehensive data means better offers for each customer

- Protected profitability: Catch fraud before it costs you

- Scalable operations: Grow your business without proportionally growing your overhead

Regulatory scrutiny on financial crime and responsible lending is intensifying. Fraud is becoming more sophisticated every day.

Beyond Document Verification

It's worth noting that effective fraud detection isn't just about checking documents. A robust approach includes:

- Credit risk assessment incorporating demographic and geographic data

- Application fraud detection including linkages, velocity checks, LMI, and LVR

- Human reviewers for edge cases that need a second look

- Fraud exchange participation through networks like FFG and AFCX

The Xapii x Fortiro integration sits at the heart of this ecosystem, but it works best when it's part of a comprehensive fraud prevention strategy.

If you're a lender conducting affordability assessments from multiple sources, the Xapii x Fortiro integration delivers what you need: a consolidated hub instead of fragmented systems, automated fraud detection out-of-the-box, consistent decisioning across all applications, and the ability to scale without sacrificing risk management.