Gain the upper hand on fraud

Get secure document collection and use AI to analyse over 100+ fraud checks on documents to identify evidence of tampering or manipulation in real time.Access to robust data

Improve digital validation rates with Statement OCR as a data sourceGain deeper insights

Leverage transaction or open banking data to gain deeper insights into income, expenses and liabilities to analyse financial behaviours.

Trusted by:

Key features

Advanced document digitisation and fraud detection

Unlock the power of Xapii's advanced OCR technology, digitizing financial statements across Australia's institutions while AI-powered fraud detection checks every document against tampering and manipulation.

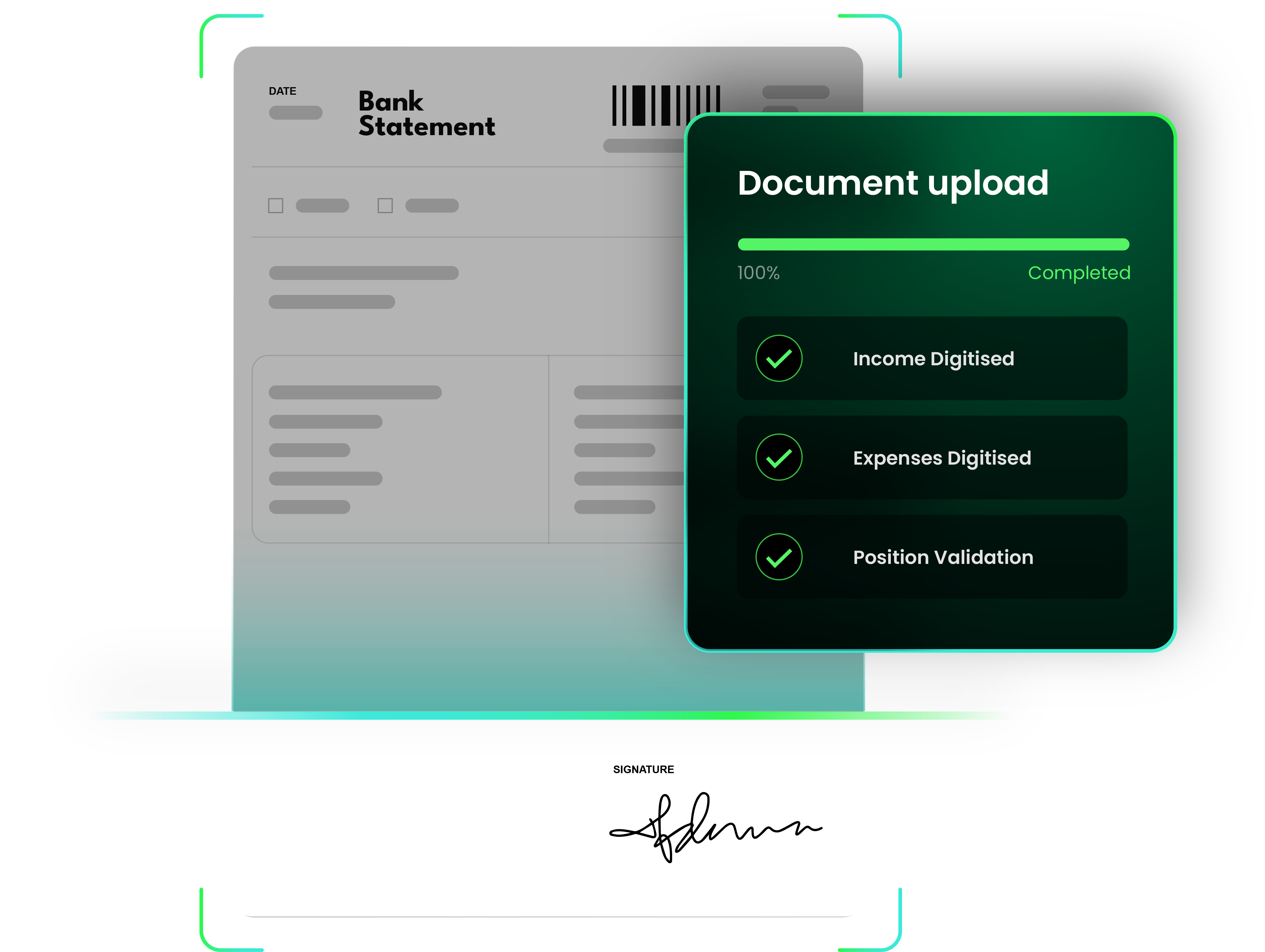

Automated digitisation

Real-time digitisation of statement account and transaction info

Tiimely's Statement OCR capability is designed to maximise trust and minimise the risk of incorrectly digitising statements. Automate the identification of income, expense and liability position.

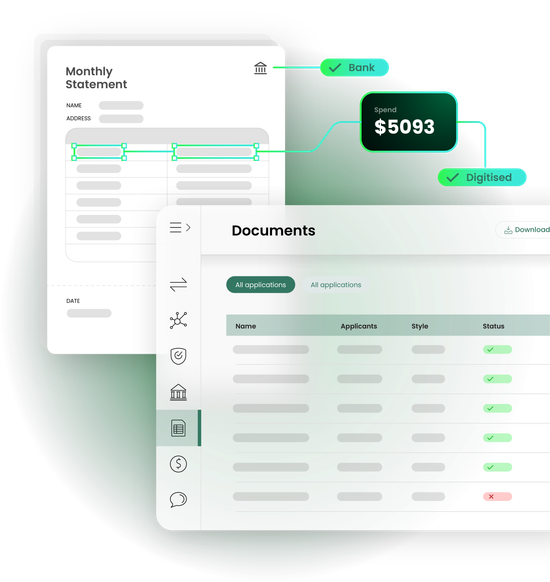

User experience

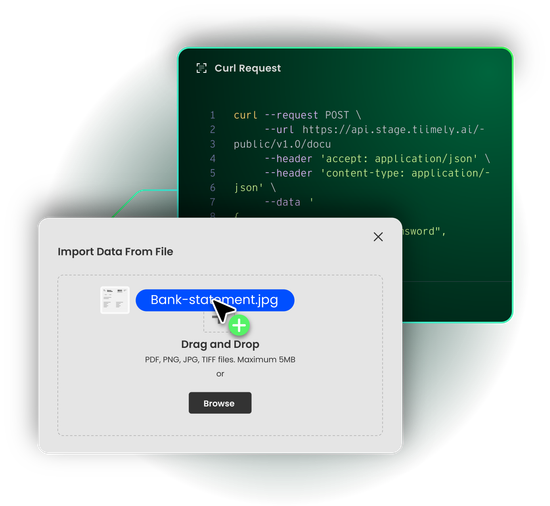

Collect, upload and manage documents via an intuitive UI or secure API

Supported by easy-to-understand statuses so your team can quickly understand the different stages of digitisation

Document Fraud

Gain the upper hand with AI-powered fraud detection

Xapii's embedded AI and tools help fight fraud withdocument fraud and OCR detection.

- 100+ document fraud checks in seconds

- In-depth content and document validation for ABNs, BSBs, and barcodes

- Automatically detect suspicious claim patterns

Testimonials

Customer success stories

Security and Encryption

Bank-level security and encryption

We are SOC2 compliant, ISO certified, have embedded digital compliance and are CDR and ADR accredited.