Meet Tiimely Home

Tiimely Home is the first customer and proving ground for Tiimely's innovative technology solutions. By integrating Tiimely's end-to-end white-label solution and Xapii technology, Tiimely Home provides borrowers with cost-effective products, rapid home loan decisions, and superior customer service. Learnings from borrowers, assessors and the market are fed back into the development and enhancement of the technology, which benefits Tiimely’s customers.

| Opportunity | There’s a common trade off in business where you can only have two of the following three things: leading edge innovation; speed to market; and low risk. Tiimely customers are looking for innovative lending solutions that will transform their customer experiences and business economics. But they also want a solution that is reliable, safe and quick to market. Typical digital transformation projects are slow and expensive, and the static solution, while safe, becomes outdated as soon as its launched. |

|---|---|

Solution | A proving ground business model that tests technology solutions in market. As Tiimely’s very first customer and in-house proving ground, Tiimely Home is a live demonstration of the effectiveness of Tiimely’s white-label solution and deep utilisation of Xapii software. Having digitised and codified Bendigo and Adelaide Banks credit policy in 2017, it pioneered exception-based and automated underwriting, which once proved, was then offered to the market. Since then, Tiimely Home has continued to test ongoing improvements to the customer journey, lending assessor experience, new lending products, and updates to data models for improved data enrichment and automation. By leveraging Tiimely Home’s experiences and people capability, Tiimely’s customers gain access to scalable, innovative solutions that are leading edge without the risks of being bleeding edge. This approach ensures that lenders can quickly adopt latest technologies to get to market faster, while having the confidence the solutions have been tested and hardened in market. |

Proven benefits

World class exception-based underwriting

3%

Of total Australian home loan market enquiries enabled by Tiimely's platform

8x

More efficient than traditional assessment, by utilising auto decisioning & exception-based fulfilment

4.6 out of 5 stars

Average Tiimely Home rating on TrustPilot after 7+ years

Millions of data points

The learnings from these result in market-leading automation and faster outcomes for customers.

Proven results

Testing solutions in a live retail environment tests real-world validation, ensuring Tiimely’s technology solutions perform effectively under real-time market conditions. This helps in identifying any practical issues or unforeseen challenges that may not surface during controlled testing.

Cost effective innovation

By continuously testing and refining solutions in a retail setting, Tiimely enables its customers to access and accelerate ongoing innovation. The tight feedback loop and iterative process managed under one roof, allows for rapid improvements, ultimately leading to more advanced, market-leading and competitive offerings.

Customer-centric enhancements

Direct feedback from end-users (including borrowers, assessors, and technology teams) provides invaluable insights into customer preferences and pain points. This enables Tiimely’s customers to make customer-centric enhancements, improving overall satisfaction and loyalty.

Risk mitigation

Testing and hardening solutions via the Tiimely Home retail environment helps mitigate risks for customers. Tiimely utilises its proving ground to identify and resolve potential issues to increase assurance that our technology is robust, reliable, and less likely to encounter significant problems post-launch.

Market readiness

Having a proving ground model accelerates the development cycle, allowing customers to bring products to market more quickly. Tiimely’s customers have confidence in Tiimely’s capability to deliver innovative, stable and reliable solutions, quickly and efficiently.

Conclusion

Tiimely Home has pioneered innovation in home loans, since 2017. By using, testing and proving Tiimely's market-leading solutions, Tiimely Home demonstrates the significant efficiency gains, cost savings, and superior customer experiences that can be delivered via both Tiimely’s White Label Mortgage Solution and Xapii solutions. Importantly, Tiimely Home exists to help deliver scalable, ongoing innovation to all Tiimely customers.

White Label

How did Tiimely help?

White label mortgage solution

As a proving ground for Tiimely's products, features and solutions, Tiimely Home is an ever evolving platform that saves businesses money, customers time and gathers learnings that are made available to platform partners.

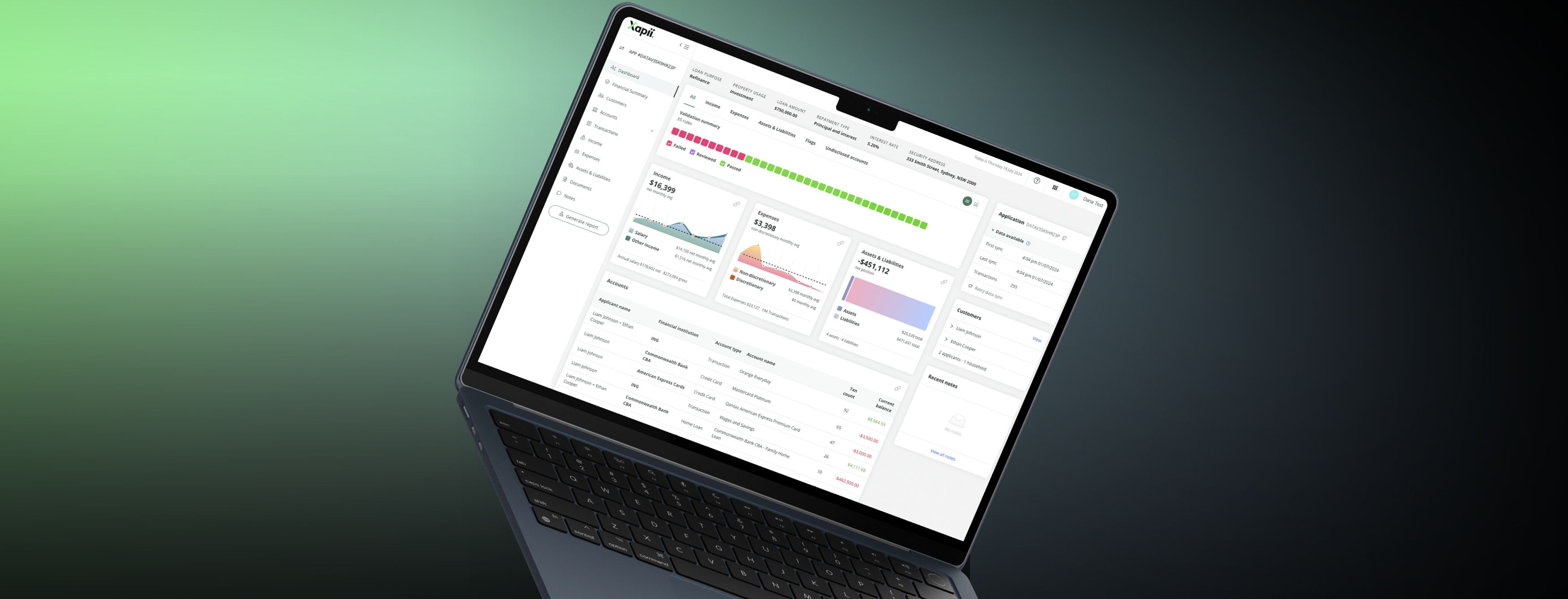

Deep integration of Xapii software

Xapii solutions do the heavy lifting for you to increase customer conversion, take cost out, while creating a lending application experience your customers will love. Be confident that whether you’re building on or building new, Tiimely’s API-powered and modularised solutions integrate with new and existing tech stacks.

Leveraging Tiimely experts

Tiimely's fully trained and experienced underwriting team qualify and convert leads for you. Your customers get access to a seamless digital experience, from application and assessment, through to settlement, including automated document generation and e-sign.

Other case studies

Up

Up uses Tiimely tech to power their in-app Home Zone conditional pre-approval tool to help customers understand borrowing capacity and home loan readinessView Case Study

Bendigo and Adelaide Bank

Bendigo and Adelaide Bank launched their online-only home loan, Bendigo Express, in 2019 through Tiimely’s white-labelled mortgage solutionView Case Study

Tiimely Home

Tiimely’s proving ground and first Enterprise customer, Tiimely Home, tests the power of Tiimely’s platform technology, enabling all customers to license ongoing innovationView Case Study