Digital Transformation: The technology adoption and implementation dilemma

“When digital transformation is done right, it’s like a caterpillar turning into a butterfly, but when done wrong, all you have is a really fast caterpillar.” - George Westerman | Principal Research Scientist, MIT

February 19, 2025

Insights

Understanding the distinction

Digitisation refers to the automation of manual processes - updating BAU processes to their digital versions. While modernising some functions, to truly transform a business is to realise the full potential of automation creating efficiencies across operations and augmenting team capability.

In the rapid evolution of technology, more businesses feel pressured to stay relevant, as Jared Lane notes in his Forbes article; “In their hurry to jump on the digital transformation bandwagon, many organizations are now obsessed with what technology they use and how to meet implementation timelines — all without any focus on business outcomes.”

It’s simplistic to think that digital transformation is adopting a ‘technology-first’ approach.

Decisions made on technology in isolation fail to lay robust foundations that solve for immediate pain points yet with enough flex to support growth and respond to future business challenges.

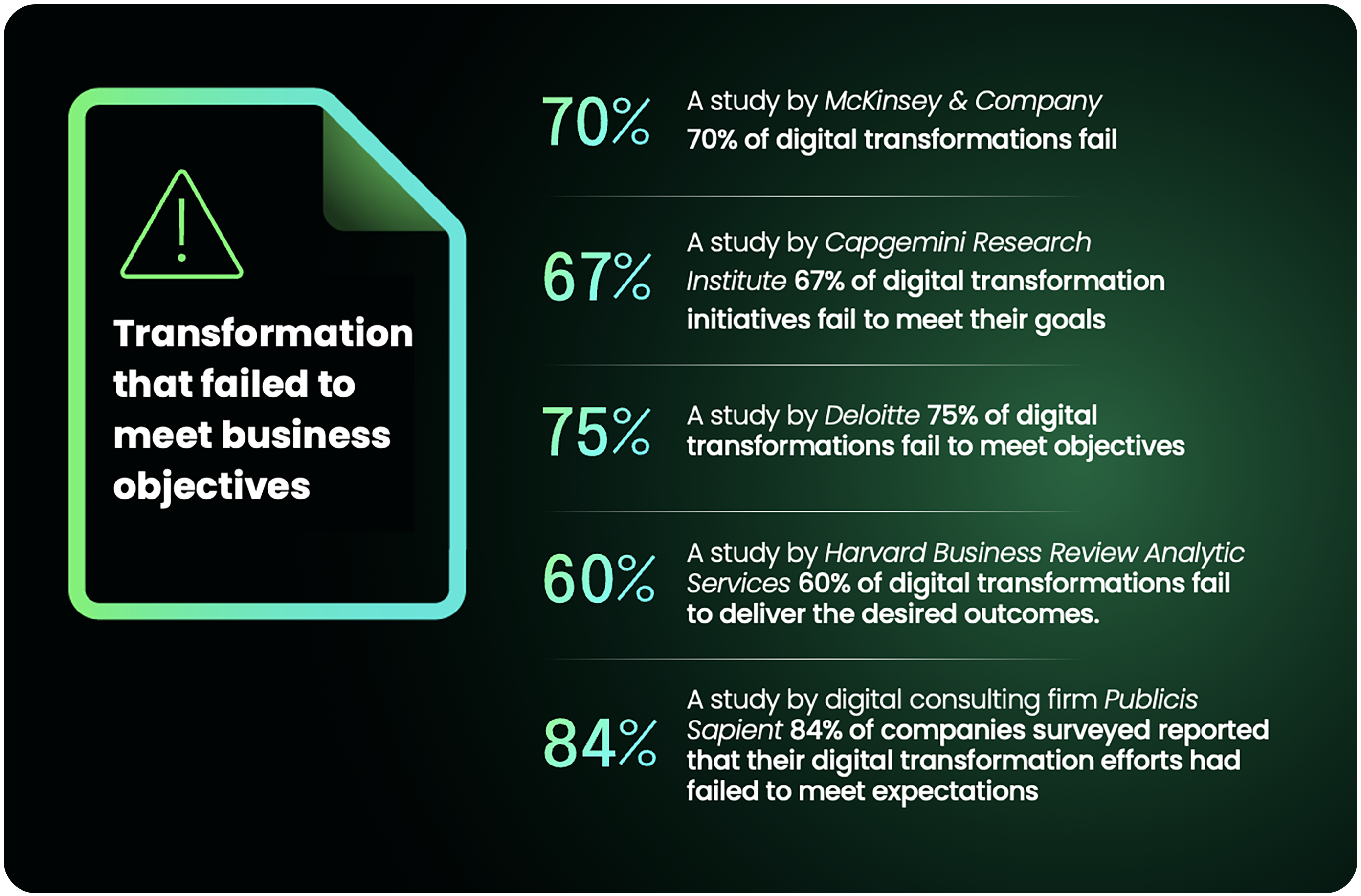

Digital transformation fails up to 84% of the time

The benefits of transformation have both short and long-term gains. Removing manual processes, updating legacy systems and reducing ‘cost to serve’ are vital to business efficiency, growth and sustainability. However, systems need proper integration, teams need to be able to pivot - understanding how to capitalise on the type of work they’re now able (and required) to do. And even if a business ‘gets to market’ with speed, the risk of tech debt is often a false economy that could offset any gains or even cripple the business.

The stats showing the number of businesses that fail to successfully deliver on this major change initiative, are sobering:

The reasons transformation projects fall short of achieving objectives are varied; failure to establish clear goals, lack of stakeholder buy-in, ineffective planning, inadequate resourcing and budget allocation or simply poor execution.

Digital Transformation comes with high stakes if plans fail. Alternatively, when implementation is successful the effects on businesses can be felt long term both in financial viability and the ability to scale sustainable operations.

The speed to market of build is yet to compete with ready access to technology that can augment and strengthen existing stacks. The unfortunate reality is that transformation projects fail in many cases because, by the time they’re complete, the technology implemented is already obsolete, with the potential of creating a barrier to any future tech adoption.

The different approaches to transformation

Build (Custom build or augment)

‘Build’ can mean both custom technology infrastructure built from scratch or a composable solution that combines existing or legacy tech augmented with SaaS technology solutions to deepen capability or solve discrete challenges. Building an entire bespoke platform can be both costly and risky, requiring internal expertise, coupled with technical ability and a culture of true collaboration. It also needs to be executed with precision and speed in order to develop a solution that enables immediate efficiency with enduring compatibility. Build also demands a substantial budget, with larger corporations allocating in the billions of dollars to remain competitive.

Cutting corners, deprioritising areas of implementation or low-code development may appear to ‘get to market quicker’, however, these can directly impact customisation, security and reliability. Delays expose the risk of obsolete functionality but expediting the process can result in unmanageable ‘tech debt’- negatively impacting the very business strategy of efficiency and scale.

Legacy systems slow many banks down, preventing them from being agile and responsive. Outdated technology can be a costly burden, limiting their ability to innovate and improve customer experiences. According to industry studies, up to 80% of IT budgets in banks are consumed by maintaining these legacy systems, leaving little room for innovation

McKinsey

Buy (end-to-end platform or open architecture)

‘Buy vs Build’ is a well-worn battleground. As surfaced above, build comes with a set of challenges such as time, expertise, alignment and budget.

‘Buy’, however is the ultimate ‘quick to market’ strategy but there are pitfalls on the road to reaping the benefits of immediacy such as ensuring your internal team has the skill to capitalise on access to an instant market. Training takes time and pulls focus from operational function and packaging up operational support with the technology comes with additional cost, relinquishing a certain level of oversight and control.

A technology partner (FaaS) can create the connective tissue between the core business, augmented efficiency and even integrate with third-party platforms. This middle ground is often the ‘goldilocks’ of digital transformation pathways. One that keeps the essence of a business, retaining legacy technology and augmenting with an open architecture technology solution.

This integration highlights the importance of two-way API with full data sets which is amplified in financial services industries, with AI expectations significantly higher due to automation of operational tasks.

A recent Accenture report identified that ~ 67% of working hours in the global banking industry are in scope for automation or augmentation by generative AI, topped only by software and capital markets. In Australia, we are in the top 4 at 45%.

Fintech as a Service (Technology partnership as an implementation strategy)

A third option is to license innovation directly from those with expertise and capability. Businesses benefit from continual innovation while concentrating on their business. Level of success and reduced friction is optimised through like-minded partnerships with alignment on overall vision, roadmap and features.

Examples in market are AMP x Starling and Tiimely X Up Bank collaborations.

Synergies with partners is key to accelerating the achievement of business KPIs. Key technology capabilities such as seamless integration and scalability are vital to set robust foundations, delivering results immediately and reliably, and support growth.

Transforming digital capability, however, is not an ‘end game’. Is your solution able to handle vast volumes of financial data with ease? Is there framework for real-time data processing? And the capability to seamlessly support audits and compliance requirements? Does the solution support your workforce to level up easily and quickly?

Technology in isolation of the human aspect only considers part of the equation. Increased output without increasing headcount creates space for teams to contribute a more meaningful part of the customer experience. In an environment where technology is automating repetitive administrative and manual tasks, strengthening human connection and influence with customers could very well become the competitive advantage.

Mutuals are well placed to lead this focus with their ‘member-first’ position, and neobanks that have the advantage of niche tailoring of their products that values and prioritises experience and attitude are clearly signalling to the market that things are definitely changing.

POC to business rollout (innovation incubator model)

A common enterprise challenge is that myriad business ideas require time and effort to vet for viability, even before addressing the executional possibilities, resulting in analysis paralysis.

Utilising an ‘innovation sandbox’ gives stakeholders access to a controlled digital environment and the tools to build innovation concepts in real-time.

This simulated environment promotes creativity in exploration and experimentation while quarantining development from real-world risks, creating space for vague concepts to be developed into solid hypotheses that can be tested in a cost-effective and timely way.

Technology that is ‘human by design’, and by a continued practice

It is not simply a matter of transformation in technology alone; managed integrations empower and support teams to use the time created efficiently to generate positive business outcomes. This is the advantage ‘in play’ - the important interplay between the technology and the people.

Tiimely is unique in its ability to harness the collaborative value of the people using the technology, referencing customer experience as a compass to inform and influence what the technology can deliver.

Paul Henninger, Head of Connected Technology at KPMG in the UK, identified that many in the financial sector are at a pinch point in their transformation journey. "The sector is in a very strong position, having invested heavily in technology …. but this is also a moment of potential frustration," he says.

“Firms have modernised and are now running on top of a more contemporary set of technologies, but this has not resulted in a spontaneous change of their businesses – there is still work to do to complete the change required to realise the value of all of this new capability."

Paul Henninger, Head of Connected Technology at KPMG (UK)

Digitisation as a growth enabler

The role of digitisation in contemporary banking is a hot topic. Customer expectation and increased focus on the evolving cybersecurity landscape, has created demand for a safer transactional environment.

Ivan Mioc, ANZ’s general manager commercial broker

In recent findings; 52% of CEOs believe the key driver of digital transformation is customer-centricity and 74% say sharing data is still a significant challenge to both established customer behaviour and operations.

As technology drives rapid change, sustained growth can only be supported with efficient technology underpinned by robust risk protocols. When it comes to automated credit risk decisioning, global research has uncovered that only 24 per cent of lenders have adopted automated credit risk decisioning,with Australia and New Zealand faring only marginally better with 17 per cent adoption.

AI augmentation, in complement to automation and data enrichment, drives the ability to scale business operations without the need for additional headcount, creating opportunities for a rescoped workforce that provides a deeper, more personalised and effective service, focused on customer nuances.

The data-driven revolution

With increased access to vast amounts of data, lenders have greater visibility into the holistic financial health picture of borrowers. Easy access to spending behaviours, creditworthiness and lending history streamlines assessment and opens the door to applying these same habits and calculations to forward plan, offering tailored lending solutions to improve customer experiences that foster long-term relationships and lay the foundations for loyalty.

Summary

What should you know before embarking on the digital transformation journey:

- Digital transformation often fails (with failure rates as high as 84%) due to poor planning, lack of stakeholder buy-in, and obsolete implementation.

- Custom-built technology infrastructure offers flexibility but poses risks such as technical debt and security concerns.

- Legacy systems hinder innovation, with banks spending up to 80% of IT budgets on maintenance.

- Integration with third-party platforms and AI adoption is crucial in the financial services industry.

- Effective digital transformation requires technology partnerships that enable compliance, data processing and scalability.

- Ultimately, successful digital transformation is about balancing technological innovation with a focus on human collaboration and business outcomes.

Achieving successful digital transformation in lending decision-making requires more than just adopting the latest technology.

Platforms like Xapii by Tiimely, are well-positioned to bridge the gap between vision and execution – with both targeted SaaS solutions to augment other technologies or an end-to-end offering for rapid digital transformation. Built on open architecture framework, with robust capabilities for seamless integration, real-time data processing, and compliance support, Xapii empowers financial institutions to transform operations while remaining agile and future-ready. Xapii harnesses collaborative intelligence, enabling lenders to make smarter decisions, automate workflows, and create frictionless customer experiences. This builds resilient infrastructures capable of delivering value both in today’s landscape and well into the future.

Appendix

Found in: