Navigating Financial Hardship in Australia: ASIC Insights, Key Lending Principles, and Xapii's Technological Solutions

The ongoing cost of living crisis has placed significant financial strain on many Australians, intensifying issues related to housing affordability, utility costs, and daily expenses. This economic pressure, driven by factors such as inflation, rising interest rates, and global economic uncertainties, has left many households grappling with the challenge of meeting their financial obligations.

August 26, 2024

Insights

Recent data highlights the gravity of the situation: as of 2023, 1 in 5 Australian households reported experiencing some form of financial hardship, a stark increase from previous years.

This growing financial instability has led to an increase in hardship cases, particularly in the realm of home lending. Mortgage repayments, which often constitute a large portion of household expenses, have become increasingly difficult for many Australians to manage. In response to this, the Australian Securities and Investments Commission (ASIC) released two critical reports in May 2024—REP 782 and REP 783—addressing the deficiencies within Australia's home lending industry, particularly concerning financial hardship.

Overview of ASIC Reports and Financial Hardship in Australia

Financial hardship occurs when individuals or households struggle to meet their financial commitments due to unforeseen circumstances such as job loss, illness, or rising living costs. Mortgage repayments are especially impacted, given their significant share of household expenses. ASIC's reports revealed that many lenders are falling short in supporting customers facing financial distress. The reports identified key areas for improvement, including simplifying the process for seeking hardship assistance and adopting a more empathetic approach towards customers.

REP 782– “Hardship, hard to get help”: Findings and actions to support customers in financial hardship

This report focused on how lenders managed hardship cases among their customers. The report highlighted that many lenders were failing to provide adequate support to customers in financial distress. Many of the processes reviewed found seeking hardship assistance was complicated and inaccessible, with many customers dropping out of the process at least once due to the challenges they faced through the process. ASIC called for lenders to simplify their processes and offer more tailored support to customers.

REP 783 – “Hardship, hard to get help”: Lenders fall short in financial hardship support

REP 783 revealed that a significant proportion of customers who received hardship assistance ended up falling into arrears soon after the assistance period ended. ASIC urged lenders to improve their practices and take a more empathetic and proactive approach to helping customers in financial hardship. The report went on to list better communication, more personalised support, and ensuring that vulnerable customers, such as those experiencing family violence, receive appropriate assistance as some of the ways to improve hardship practices.

A key criticism made by ASIC of lenders was the application of a "one-size-fits-all" approach because of its inability to consider the unique circumstances of individual customers.

In this article, we’ll delve into what makes an effective hardship solution in the context of lending. We will examine the core principles that should guide lenders in offering tailored, scalable, sustainable, and supportive assistance to customers facing financial difficulties. Additionally, we’ll explore how Xapii®’s innovative solutions, Xapii® Convert and Xapii® Decide, can play a pivotal role in enhancing the effectiveness of hardship management by providing both early-stage assessments and in-depth financial analysis. It is important to note that whilst the article focuses on how lenders can better serve their customers, the principles discussed below can also be applied to member-based organisations, and not-for-profit organisations who provide assistance and counselling to those experiencing hardship.

By the end of this article, you will have a clear understanding of the current challenges in the home lending industry, the key components of an effective hardship solution, and how leveraging advanced technology can lead to better outcomes for both lenders and customers.

What makes an effective hardship solution?

Effectiveness is subjective. In this scenario, solutions are deemed effective if they benefit both the customer and the Hardship Assistance team – this is a product development principle at Tiimely, also known as ‘two-way digital’.

Must be easy

For your customers

- Notifying a lender of hardship can leave customers feeling exposed and exposed therefore the notification process must be easy for customers to make contact, and to provide relevant information

- Customers dealing with multiple lenders often need to repeat this conversation with multiple lenders, so removing barriers like long on-hold periods (via phone) or ensuring calls are returned within a reasonable time can add to a sense of ease for the customer

For your team

- Collecting customer info must be easy and provide contextual information so personalised payment plans can be communicated and agreed to with the customer

- Processes, practices and tooling must be intuitive and automated where possible so that your team’s time is freed up to spend with the customer instead of in assessment

Must enable effective communication

- Your team should feel informed and able to have timely and meaningful conversations with customers based on information collected and assessed. Effective tooling can enable this, allowing your people to focus on what's important: the customer

- Customers also want to understand their financial situation and what the next steps are soon after they’ve made contact. Overcommunicating with the customer during this time will help alleviate some of the stress and anxiety the customer could be experiencing. Providing clear direction and payment plans during this time is critical to getting customers back to financial stability

Must be scalable, auditable and extensible

Scalable

With hardship on the rise, your solution must be able to handle volume and support iterative hardship assessment over time.

Auditable

Ensuring your processes and decision making is trackable and auditable is a non-negotiable. Similar to approving a customer for a long, a hardship application should provide information about when the assessment was initially conducted, by whom, what changed and how it has progressed.

Extensible

Extensibility across a lending platform allows lenders to handle multiple asset classes and provide insights into potential hardship with other financial institutions. Generally, if a customer is experiencing hardship with your lending products, they’re likely experiencing this with other lenders too. It’s critical that a hardship solution solves for all your lending products and provides insights into external lending relationships.

Xapii for Hardship

Hardship solutions must support your customers and team across the hardship lifecycle, and beyond - over time, organisations should leverage their data and tech capabilities to predict potential hardship scenarios and prevent them from materialising.

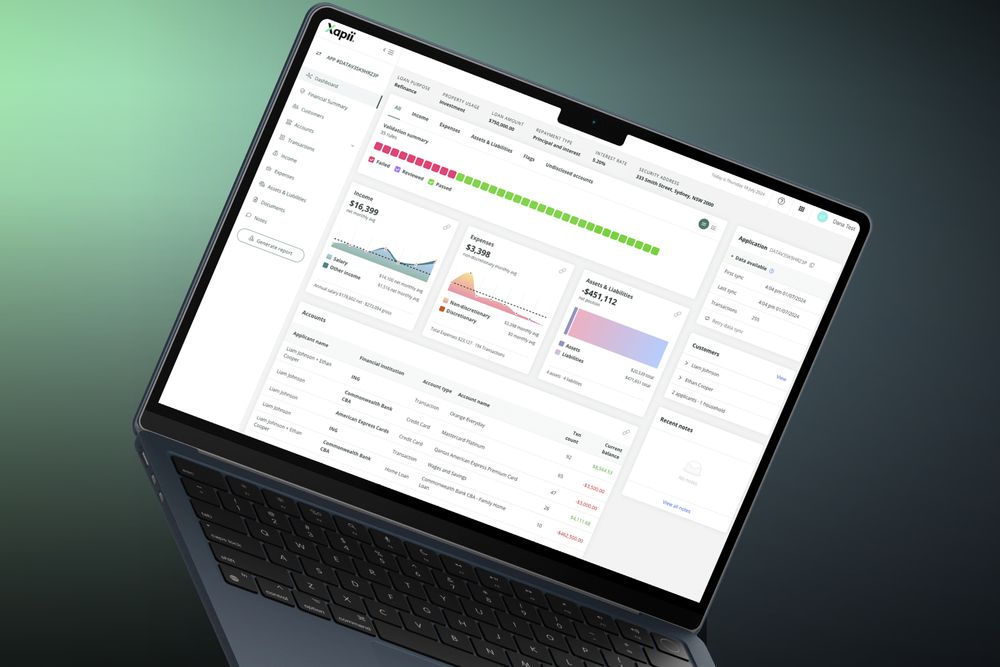

Here we'll explore how Xapii's componentised solutions, Xapii® Convert and Xapii® Decide, can be applied in the Hardship use case.

Xapii® Convert powers low-touch, frictionless and highly accurate experiences for early-stage assessments and is suitable in scenarios where customer declared financial information is used. For more complicated, long-term cases, Xapii® Decide is ideal as it allows for deeper financial assessment pulling in actual and validated financials for more accurate and in-depth analysis.

Xapii across the hardship cycle

Programmatic Serviceability

Xapii can configure any serviceability credit policy to allow point-in-time or ongoing financial assessments for serviceability

Long-Lived Applications

Xapii applications can be evolved over time as customer circumstances change for an end-to-end view

Data Collection and Validation

Xapii can collect data from a variety of sources to validate the customer financial position. This includes declared financials from the customer, Statement OCR, scraped data, Open Banking or direct bank feeds.

A consolidated repository for all documents required to support hardship assessments with a range of automation including document classification, automated TFN redaction, and Statement OCR.

Policy Rules and Trigger Detection

Income, expense, liability and cash asset automation including data enrichment, financial position detection and out-of-the-box integration with serviceability.

Data enrichment and Financial Position Detection

Ability to identify behavioural triggers, risk indicators and validate policy checks.

Found in: