Automated Financial Data Processing: What it is and how to automate your data analysis process

Financial institutions handle massive volumes of data every day. Bank statements, payslips, transaction histories, and application forms all contain critical information, but in formats that can be difficult to work with.

November 10, 2025

Insights

Financial institutions handle massive volumes of data every day.

Bank statements, payslips, transaction histories, and application forms all contain critical information, but in formats that can be difficult to work with.

Transforming unstructured documents and raw transactions into enriched, validated information that can drive decisions often results in time consuming, manual processes. Automated financial data processing solves this problem, using technology to digitise documents, enrich transaction data, and turn disconnected information into actionable intelligence.

What is automated financial data processing?

Automated financial data processing uses AI and optical character recognition (OCR) to handle the data lifecycle from collection through analysis to decision making.

Instead of manually reviewing bank statements, categorising transactions, and calculating serviceability, automated systems do this work. They pull data from multiple sources, validate and enrich it, apply business rules, and generate decisions or recommendations.

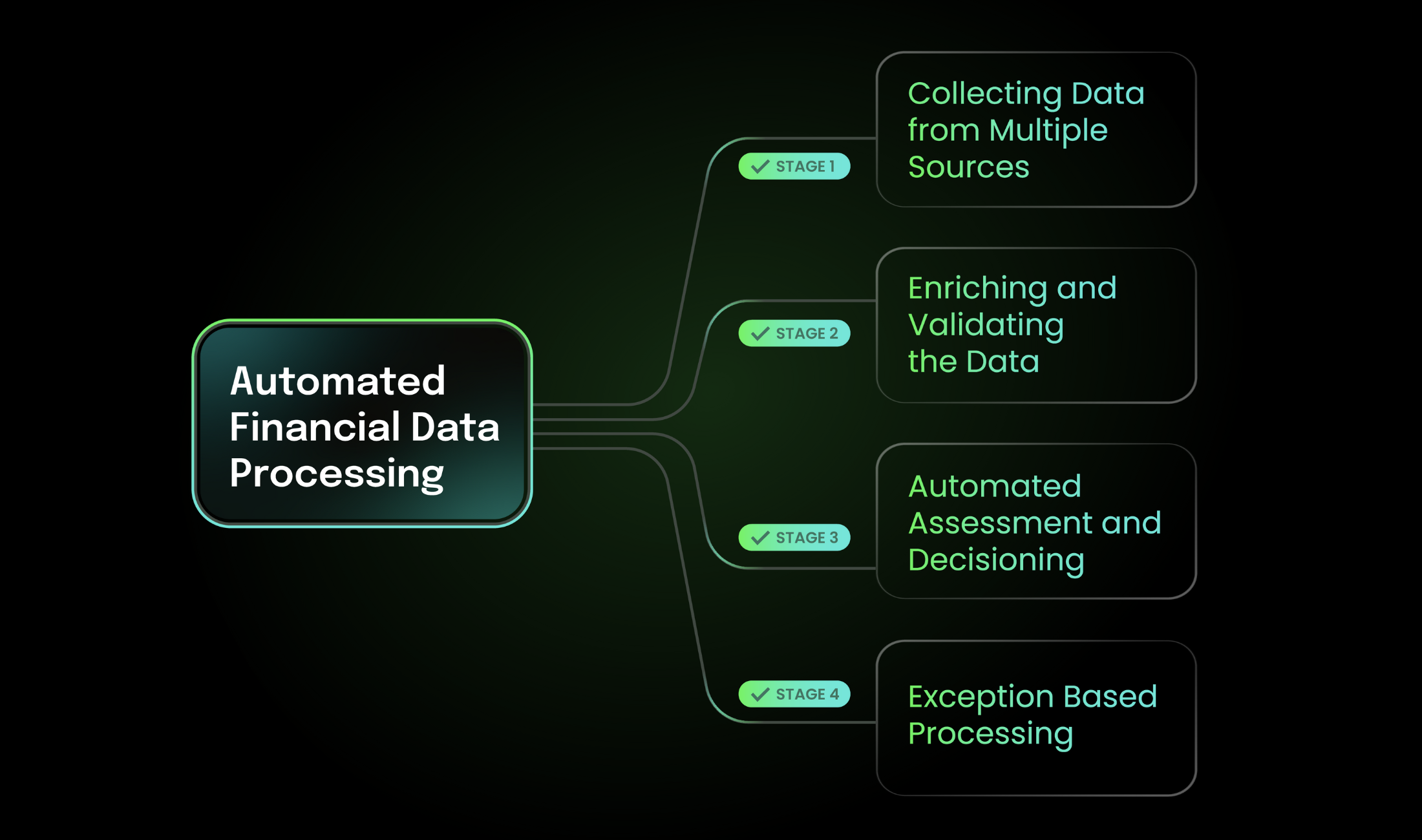

The process includes four stages:

Data Collection: Gathering financial information from Open Banking APIs, bank statements, data aggregation platforms, or direct customer uploads.

Data Enrichment: Cleaning, categorising, and enhancing the raw data by identifying income types, classifying expenses, detecting patterns, and flagging anomalies.

Automated Analysis: Applying business rules to the enriched data, checking debt-to-income ratios, calculating affordability, and assessing risk factors.

Decision Support: Making automated decisions for straightforward cases or flagging complex scenarios for human review.

Why financial institutions are automating data processing

The manual process doesn't scale

- Manual data processing creates problems

- Applications that could be approved in minutes take days

- You need large teams to handle volumes

- Different analysts interpret the same data differently

- Increasing volumes means increasing head count

How automated financial data processing works

Stage 1: Collecting data from multiple sources

The first challenge is consolidating all relevant financial data. Modern systems, like Xapii, ingest data through several channels:

Open Banking APIs provide secure, customer-consented access to real-time bank account data. This is the preferred method in markets with Consumer Data Right frameworks.

OCR technology extracts data from uploaded documents like PDF bank statements, payslips, and tax returns. Advanced OCR systems handle nearly half of all statement types across different banks and formats.

Data aggregation services connect to multiple financial institutions on the customer's behalf, consolidating information from accounts across different banks.

Direct data uploads let customers provide their own files when other methods aren't available.

Stage 2: Enriching and validating the data

Raw transaction data isn't immediately useful. A bank statement shows hundreds of transactions, but identifying the type of transaction can be difficult.

Data enrichment addresses these issues:

Transaction categorisation groups similar transactions together. Instead of seeing the same transaction multiple times, the system will categorise these into the same bucket.

Income analysis identifies different income types (base salary, overtime, bonuses, rental income) and assesses their reliability and sustainability.

Expense classification breaks spending into categories aligned with lending standards, distinguishing essential costs from discretionary spending.

Pattern recognition identifies regular payments, seasonal variations, and financial habits indicating stability or risk.

Anomaly detection flags unusual transactions like late payment fees, dishonoured payments, high-risk merchant transactions, or undisclosed debts.

Advanced systems apply machine learning models trained on millions of transactions, improving their pattern recognition over time.

Stage 3: Automated assessment and decisioning

Once data is enriched, automated systems apply a business’s policies and rules:

- Calculating actual income based on verified transactions rather than stated amounts

- Comparing expenses against industry benchmarks

- Computing debt serviceability ratios

- Checking loan-to-value ratios for secured lending

- Assessing employment stability and income consistency

- Evaluating against hundreds of specific policy rules

Stage 4: Exception based processing

Not every application should be fully automated. The most effective approach combines automation with human expertise:

Straight through processing handles clear cut applications that meet all criteria with no ambiguities. These get approved or declined automatically based on your rules.

Intelligent routing identifies applications needing human review, such as unusual income patterns, complex employment situations, or applications falling in grey areas of your policy.

Assisted decision making provides human assessors with enriched data and analysis, letting them focus on judgment rather than data gathering.

Over time, as the system learns from human decisions, more cases can be handled automatically while maintaining risk controls.

Implementing automated Financial data processing

Starting with assessment

Before choosing technology, understand your current state. Map your existing process from application to decision, identifying where time is spent, where errors occur, and where bottlenecks form. Measure current metrics like processing time, cost per application, and straight through rates so you can track improvements.

Define what success looks like. Are you trying to increase capacity, reduce costs, improve customer experience, or all three?

Phased Implementation

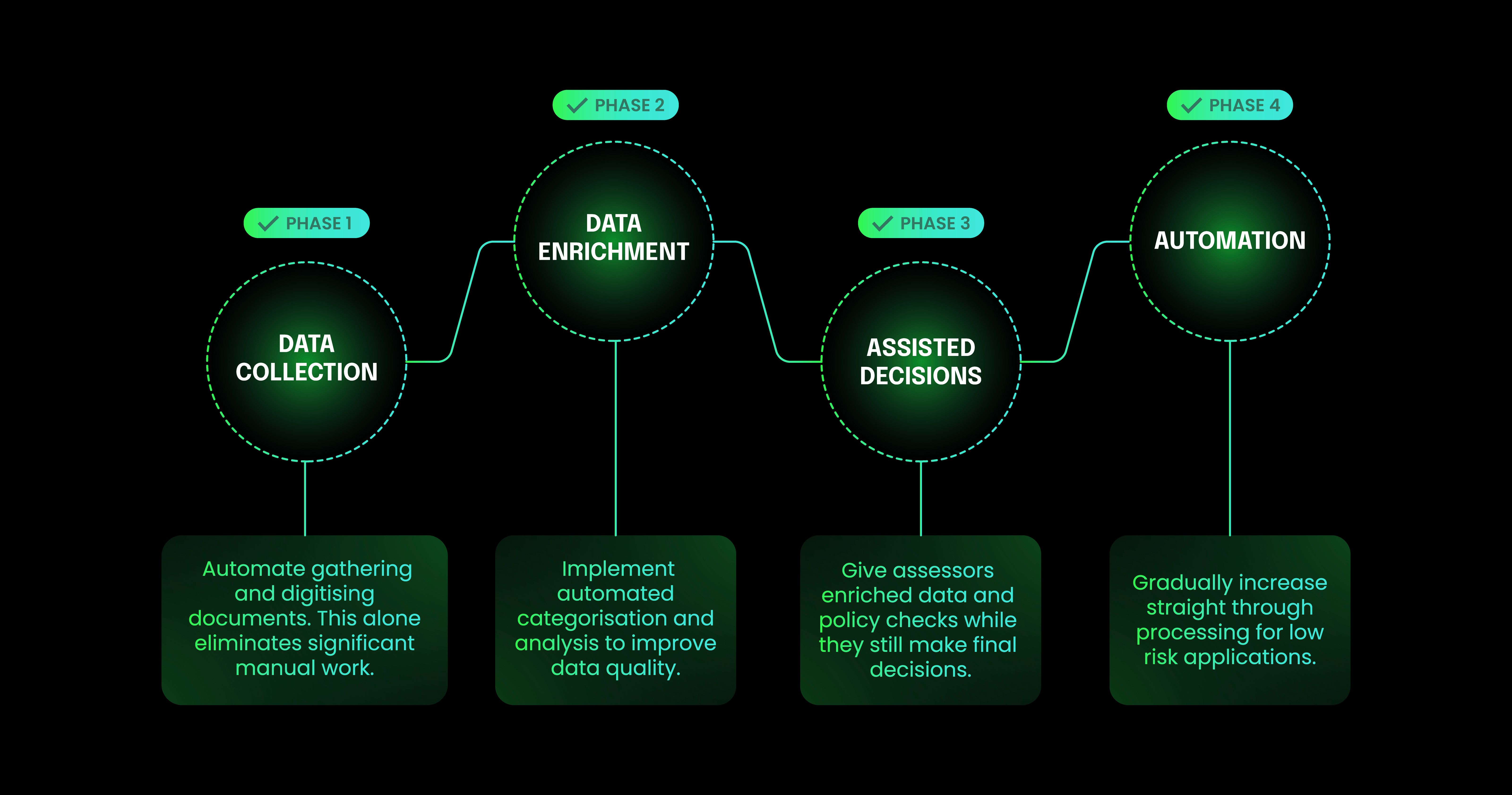

Don't try to automate everything at once. A phased approach reduces risk:

Phase 1: Data Collection - Automate gathering and digitising documents. This alone eliminates significant manual work.

Phase 2: Data Enrichment - Implement automated categorisation and analysis to improve data quality.

Phase 3: Assisted Decisions - Give assessors enriched data and policy checks while they still make final decisions.

Phase 4: Automation Gradually increase straight through processing for low risk applications.

Each phase delivers value while building toward full automation where appropriate.

Configuration and Integration

Work with your implementation team to translate your credit policies into system rules. This includes defining how to treat different income types, what expense benchmarks to apply, what debt ratios are acceptable, and which scenarios require human review.

Plan for integration with your existing technology such as loan origination systems, CRM platforms, document management, and reporting tools. Modern platforms offer API first designs that simplify these connections.

Making the Move to Automation

The businesses seeing the greatest success with automation aren't the ones with the biggest budgets or largest teams—they're the ones that started with clear goals and took a phased approach.

By focusing on data quality first, implementing in stages, and maintaining the right balance between automation and human expertise, these organisations have transformed their operations while improving the customer experience.

If you're ready to explore what automated financial data processing can do for your business, start by identifying your biggest bottlenecks and talking to platform providers who've proven themselves in your industry.

The technology is mature, the results are measurable, and the competitive pressure to modernise is only increasing.

Related articles

Insights

Essential capabilities of modern decisioning platforms for lending

TiimelyOct 27, 2025

Insights

Embedded Finance and AI Integration. ‘AI out of the box’ - Efficient and relevant diversification

Tania DeMasiMay 22, 2025

Insights

Credit decisioning platforms: Evaluating effectiveness for lending

Tania De MasiSep 17, 2025