Essential capabilities of modern decisioning platforms for lending

Choosing the right decisioning platform isn't just about automation it's about finding a solution that can handle complex credit assessments whilst maintaining the flexibility and control your team needs.

October 27, 2025

Insights

Credit assessment has evolved dramatically in recent years.

Manual underwriting processes that once took days can now be completed in minutes through automated decisioning platforms, but only when those platforms have the right capabilities built in.

Choosing the right decisioning platform isn't just about automation it's about finding a solution that can handle complex credit assessments whilst maintaining the flexibility and control your team needs.

Here's what to look for in credit decisioning software.

Flexible data ingestion for credit decisioning

All businesses ingest different data types from different sources. Some customers upload bank statements. Others connect via Open Banking. Some loan applications arrive through aggregators, whilst others come directly from your own systems. The reality is messy, and your credit decisioning platform needs to handle data ingestion seamlessly.

The platforms that work best enable flexible data ingestion across multiple channels:

- Data aggregation: pulling information from multiple sources and consolidating it automatically

- Open Banking connections: secure, consent-based access to transaction data directly from banks

- OCR capabilities: extracting data from scanned or uploaded documents like payslips and statements

- Custom data imports: bringing your own account and transaction data from existing systems

Modern lending requires AI-powered data enrichment to transform raw data into actionable and explainable financial assessments. This means going beyond simple labels to understand context, identify patterns, and flag anomalies that matter for credit decisions.

Exception-based underwriting and automation

Exception-based underwriting represents a shift in how teams operate. Instead of every financial assessment requiring the same level of scrutiny, straightforward cases flow through automated assessment whilst complex or unusual situations get flagged for human review.

What this looks like in practice:

- Routine applications with clear income patterns get approved automatically

- Edge cases (unusual income sources, recent employment changes) get flagged for manual review

Enabling operation teams to focus on the 20-30% of applications that genuinely need expertise. This allows for credit assessment times to drop, increasing team efficiencies.

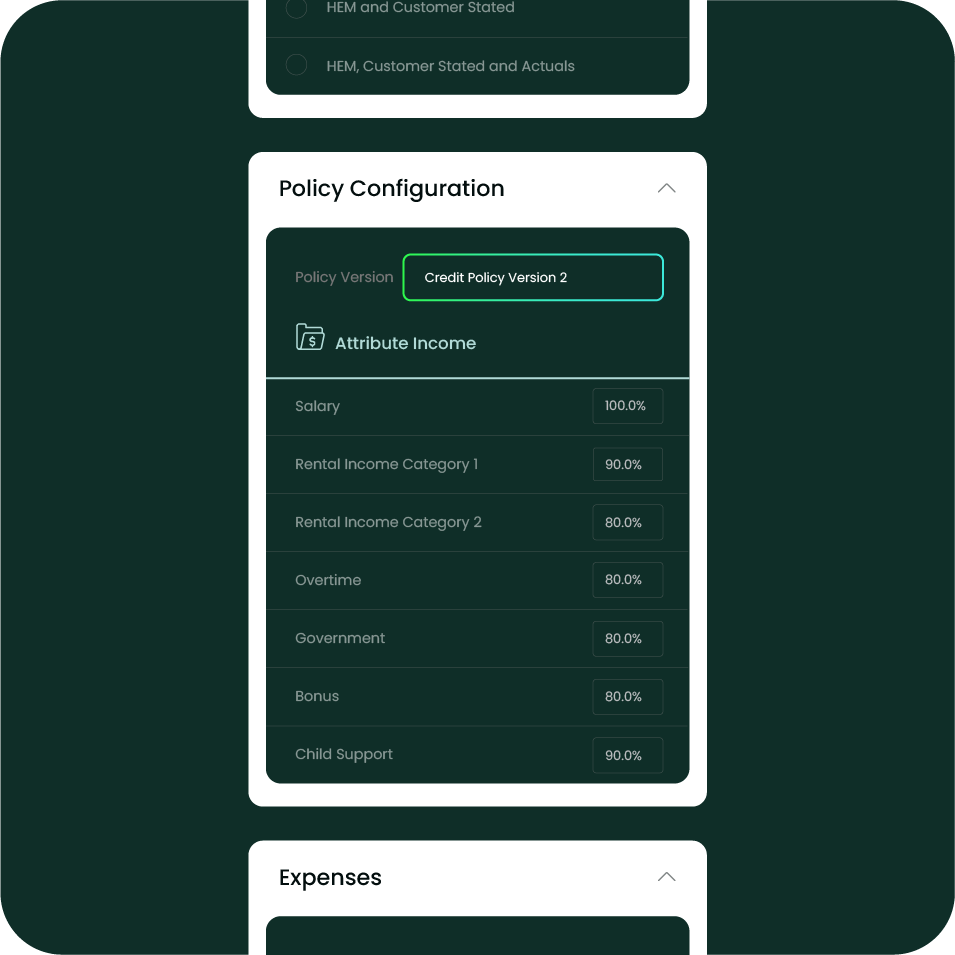

Configurable risk controls and credit policy rules

Every lender has a different risk appetite, and that appetite changes based on market conditions, funding costs, and strategic priorities. Lending decisioning platform shouldn't treat risk settings as something that gets configured once during implementation and then locked away.

The best credit decisioning platforms offer highly granular control over policy rules and risk tolerances.

Key areas where you need configurability:

- Income assessment rules: how you verify and calculate different income types

- Expense validation thresholds: when to accept declared expenses vs requiring documentation

- Debt serviceability calculations: your specific approach to determining affordability

- Policy exception triggers: what automatically requires human review

- Risk scoring parameters: how different factors weight into your overall assessment

Configurability means the platform can reflect your credit policy effectively.

End-to-end serviceability assessment

Credit decisions aren't isolated events. They're part of an ongoing customer relationship. A customer who enquires today might apply next month, get approved the month after, and consider refinancing a year down the track.

This means maintaining what the industry calls "long-lived" loan applications. As a customer's financial situation evolves, you should be able to update their serviceability assessment continuously rather than starting from scratch each time.

This continuity matters operationally but it also matters from a customer experience perspective. When you can pick up where you left off rather than asking for the same financial information repeatedly, it shows.

Audit trails and regulatory compliance

Every decision outcome your credit teams make may need to be explained.

Fully-auditable decisions ensure each assessment is transparent and explainable. This means maintaining clear records of the data used, the policy rules applied, and the reasoning behind each outcome.

If questions arise down the track, you can demonstrate exactly how and why a particular lending decision was made, which is essential for both regulatory compliance and customer trust.

Platform security and data protection

The right decisioning platform should offer bank-level security and encryption, with credentials including SOC2 compliance, ISO 27001 certification, embedded digital compliance, and both CDR and ADR accreditation in Australia.

When you're handling customers' financial information these security certifications aren't just nice-to-haves. They're fundamental requirements that demonstrate a genuine commitment to protecting sensitive financial data.

API integration and user interface flexibility

Different people in your organisation need to interact with lending decisioning in different ways. Your developers wants API access for system integration. Your underwriters need a user interface for reviewing exceptions and managing workflows. Your credit risk team wants visibility into decisions and outcomes.

Modern decisioning platforms provide both API and user interface access, letting you interact with credit decision outputs however makes sense for your specific workflow. The platform should adapt to your lending architecture and processes, not force you to adapt to its constraints.

Evaluating decisioning platforms for your organisation

The Australian digital lending market has matured significantly. Many of the country's largest banks and neo-banks now use automated decisioning for substantial portions of their lending volume. In some segments like digital home loans, automated credit decisioning powers many loan applications.

The capabilities outlined are the foundational requirements that separate transformative lending platforms from those that just create new problems.

The technology has matured to the point where genuinely excellent decisioning platforms exist, making proper evaluation and selection more critical than ever.

Related articles

Insights

AI products and services: The next frontier for the financial industry.

Tania De MasiJul 16, 2025

Insights

Embedded Finance and AI Integration. ‘AI out of the box’ - Efficient and relevant diversification

Tania DeMasiMay 22, 2025

Insights

Digital Transformation: The technology adoption and implementation dilemma

Tania DeMasiFeb 19, 2025